Industry overview and SWOT analysis

PDF version

Abbreviations.

- BET - Battery Electric Truck

- Biofuels - Usually ethanol that is produced via fermentation process of biomass (e.g. corn, starch, etc.)

- CNG - Compressed Natural Gas

- Electrofuels - Electrofuels (e-fuels) are synthetic fuels generated using renewable energy, combining hydrogen produced by electrolysis with carbon-based feedstocks.

- ERS - Electric Road Systems (ERS) provide electrical power, for example, from overhead catenary lines, which removes the need to store as much energy on vehicles.

- EU - European Union

- FCET - Hydrogen Fuel Cell Electric Truck’s (FCETs) use a fuel cell which is pumped with hydrogen - stored in a tank within the vehicle - mixed with air.

- Fuel Cell - A mechanical set-up consisting of electrodes and an electrolyte-based medium that functions as both storage and supplier of electrical energy in larger machinery

- GHG - Greenhouse Gases

- HDV - Heavy Duty vehicle – road vehicle over 3.5T, e.g. HGV, buses, coaches and ‘vocational’ vehicles such as gritters, refuse collection vehicles

- HGV - Heavy Goods Vehicle

- LCF - Low Carbon Fuels

- LNG - Liquefied Natural Gas

- MSIP - Michelin Scottish Industrial Parc

- NPF4 - Fourth National Planning Framework

- NTS2 - National Transport Strategy

- OEM - Original Equipment Manufacturers

- RTFO - Renewable Transport Fuel Obligation

- R&D - Research and Development

- SME - Small and Medium Enterprises

- STPR2 - Strategic Transport Review

- TCO - Total Cost of Operation/ Ownership

- TaaS - Trucks as a Service

- UK - United Kingdom

- ULEV - Ultra Low Emission Vehicle

- ZETs - Zero Emission Trucks

Introduction

Purpose of this paper

The purpose of this paper is to develop a common level of understanding amongst Taskforce members of the baseline position with regards to HGV operation and GHG emissions in Scotland and potential approaches to decarbonisation. The paper describes the challenges and opportunities associated with decarbonising HGVs from the viewpoint of the different parts of relevant industries and identifies barriers and uses this information to develop an evidenced based SWOT analysis for the pathway to zero emission trucks in Scotland.

Definitions and Assumptions

Zero-emission HGVs are defined as HGVs that have zero tailpipe (pump to wheel) greenhouse gas emissions at point of use. Embodied emissions associated with the creation, maintenance and disposal of vehicles or infrastructure and production and distribution of energy (well to pump) are recognised as being important but are not within the scope of this paper.

The decarbonisation of HGVs is generally accepted as requiring a mix of technology; operational change; and mode shift solutions. Whilst mode shift and changes in consumer behaviour that affect the demand for transport of goods are part of the solution, it is recognised that road freight will continue to remain a critical part of the transport system. The focus of this paper is on the reduction in tail pipe emissions for remaining HGVs through technology and operational changes and does not address mode shift or consumer behaviour.

Policy context

In 2019, transport accounted for 36% of total greenhouse gas emissions in Scotland, with HGVs accounting for around 12.3% of those emissions (Carbon Account for Transport No.12: 2020 Edition).

The Climate Change (Emissions Reduction Targets) (Scotland) Act 2019 commits Scotland to achieving a 75% reduction in emissions, relative to 1990, by 2030; 90% by 2040 and net-zero by 2045 – five years sooner than the rest of the UK. Analysis conducted by the Scottish Government has assigned the transport sector its own emissions envelope of 56% reduction by 2030, 70% reduction by 2040 and net-zero by 2045, from a 1990 baseline (Element Energy (2021), Decarbonising the Scottish Transport Sector. Report for Transport Scotland). The Climate Change Act also embeds the principles of a just transition. These principles include developing and maintaining social consensus, creating new jobs and helping to address inequality and poverty (Climate Change (Emissions Reduction Targets) (Scotland) Act 2019).

The Scottish Government’s Climate Change Plan Update includes specific commitments relating to decarbonising HGVs including working to establish a Zero Emission Heavy Duty Vehicle (HDV) programme to support innovation in the Scottish supply chain and engaging with industry to understand how changing technologies and innovations can help reduce carbon emissions (Update to the Climate Change Plan 2018-2032, December 2020). It commits to working with industry to remove the need for new petrol and diesel HDVs by 2035.

Recommendations from the Strategic Transport Review (STPR2) are aimed at rapid decarbonisation of both passenger and freight transport and include behaviour change and modal shift for freight, and zero emission vehicles and infrastructure transition. These recommendations align with and support the draft Fourth National Planning Framework (NPF4) and the National Transport Strategy (NTS2) (Summary Report – January 2022 – STPR2).

At a UK government level, the Department for Transport’s Decarbonisation Plan outlines a range of commitments to decarbonise all forms of transport. Transport policy to date remains technology neutral, focusing on emission reduction targets. While UK vehicle registration and annual vehicle taxes do not currently distinguish between HGVs in terms of CO2 emissions (Since 2019, less polluting HGVs meeting higher Euro vehicle emission standards pay a lower HGV road levy. This levy is currently suspended), capital grants, which have been available for zero-emission cars since 2011, were extended to ZETs in 2016. HGVs have also benefited from policies designed to decarbonise fuels such as the Renewable Transport Fuel Obligation (RTFO) under which suppliers must show that a percentage of the fuel they supply comes from renewable and sustainable sources; the UK Transport Decarbonisation Plan increases the target levels for these.

In November 2021, the UK government committed to phasing out new, non-zero emission HGVs weighing 26 tonnes and under by 2035, with all new HGVs sold in the UK to be zero emission by 2040 (Heavy goods vehicles: ending the sale of new non-zero emission models). Changes to legislation have also been introduced to enable the use of aerodynamic features, elongated cabs and the roll out of longer goods vehicles to reduce fuel consumption and emissions.

While not currently part of the European Union, Scotland explicitly seeks to remain aligned with EU legislation. There are also practical consequences to EU legislation on Scottish operators due to the number of cross-border operations undertaken by UK HGVs and the share of trucks manufactured in the EU. At the EU level, a greenhouse gas emissions standard for HGVs was introduced in 2019 that set targets for reducing the average emissions from new trucks for 2025 and 2030 and aims to incentivise the uptake of zero- and low-emission vehicles in a technology-neutral way (Regulation (EU) 2019/1242). The regulation is due for review in 2022.

The EU has also recently agreed to revise its road charging rules (Eurovignette directive) for HGVs from 2030, replacing time-based charges (vignettes) with distance-based tolls that will vary based on CO2 emissions (Greening road transport: EU adopts new road charging rules). Proposed EU legislation to make the Alternative Fuels Infrastructure (AFID) Directive a regulation would result in mandatory distance-based placements of electric recharging and hydrogen refuelling stations for HDVs on strategic EU routes as well as binding targets for member states to deploy refuelling/recharging infrastructure (IEA Trucks and Buses Tracking Report. November 2021).

Methodology

A mixed methods approach has been used to generate the evidence base for this paper. An initial review of published reports and policy positions was supplemented by interviews with representatives of key sectors and a workshop with SMEs and companies working in remote or rural locations that are involved in the freight and logistics sector. This included fleet owners/operators, truck manufacturers, component manufacturers (battery/fuel cells) or road freight customers.

Overview of road freight transport and GHG emissions

Introduction

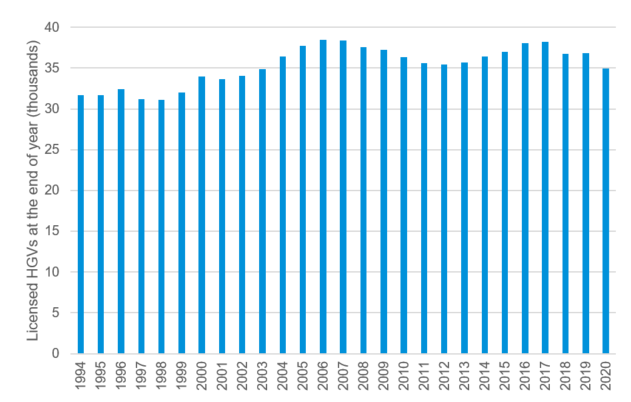

In 2020 there were around 35,000 HGVs registered in Scotland, 27,200 of which are licenced to carry goods. Approximately, 2,800 new HGVs were added to the fleet by the end of 2019 (DfT Vehicle Licensing Statistics). Data shows that there were 20 licenced ULEVs HGVs in Scotland at the end of 2021 (Transport Scotland Statistics 40: Chapter 13: Environment and Emissions).

Appendix A provides a summary of available data on the breakdown of the HGV fleet in Scotland, how these vehicles are used and an estimate of associated GHG emissions. This information is summarised in the following sections.

HGV types, use and GHG emissions

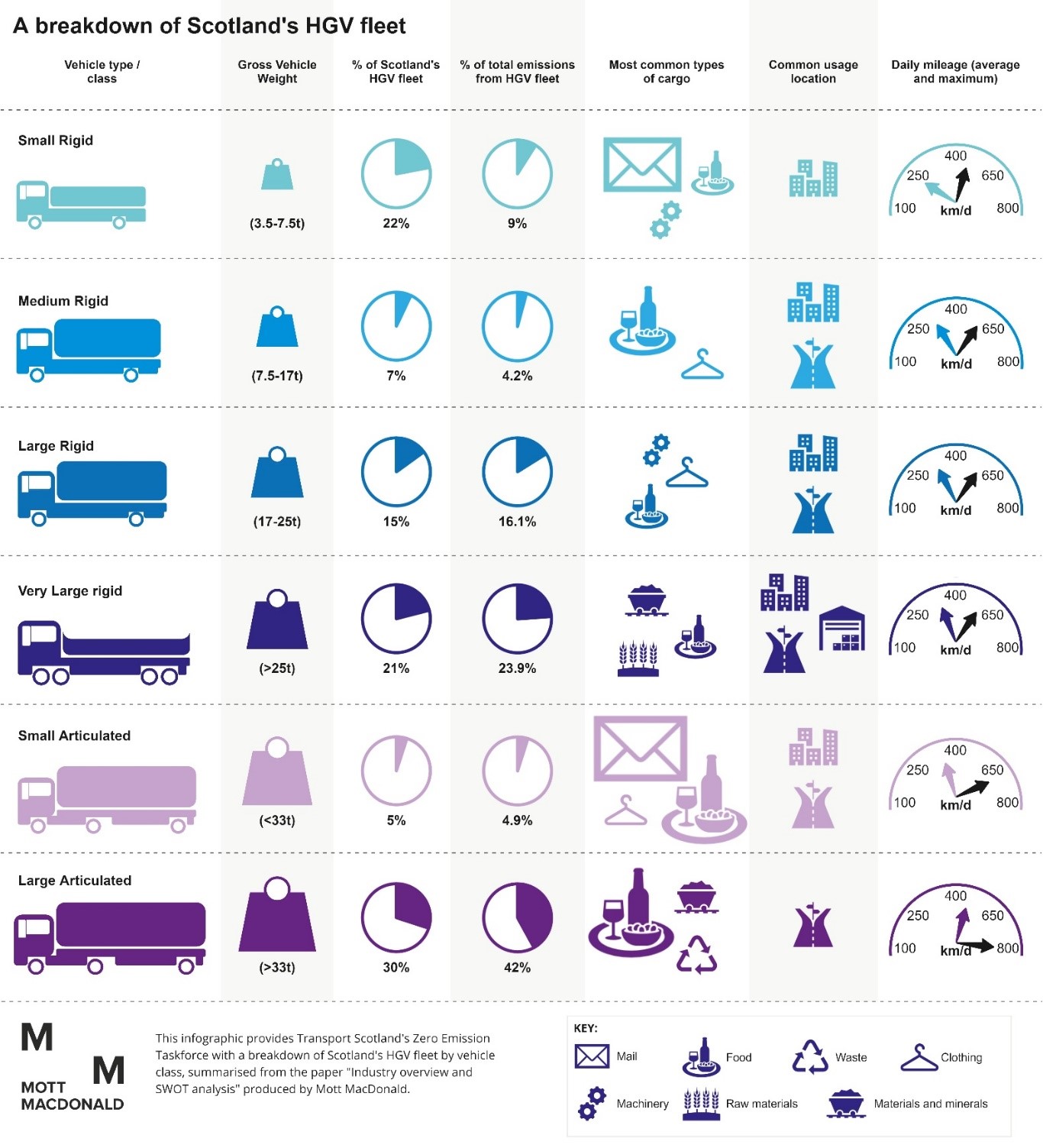

Figure 1 presents:

- The make-up of the Scottish HGV fleet by vehicle type/class and Gross Vehicle Weight

- The estimated GHG emissions from each segment (as a percentage of total HGV GHG emissions in Scotland)

- The most common cargo types for each vehicle class

- The common usage locations for each vehicle class

- The average and maximum daily mileages for each vehicle class

The segmentation information presented is taken from a ClimatexChange report prepared by Element Energy. It is noted that the vehicle segments presented include Refuse Collection Vehicles (RCVs) which are excluded from the scope of the Taskforce. RCVs exist in the medium rigid, large rigid, and very large rigid vehicle segments, though data on the percentage of each segment configured as an RCV was not available. Daily GHG emissions for each segment are estimated using the upper range of average daily mileage figures presented and the UK Government 2021 GHG Conversion Factors for Average laden HGVs. As RCVs operate with lower mileage ranges, the inclusion of RCVs is not expected to have a significant effect on the GHG emission figures presented.

The data reveals that whilst there are some GHG emission hot spots, emissions are generated from a wide variety of vehicle types, goods moved and journey types. A summary of the key findings is provided below.

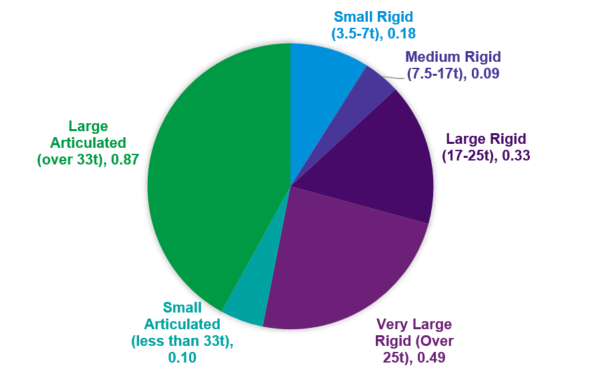

- The HGV fleet in Scotland is made up of a wide variety of vehicle types, with 30% registered as large articulated (over 33t), 22% small rigid (3.5-7.5t), 21% very large rigid (over 25t) and 15% large rigid (17-25t)

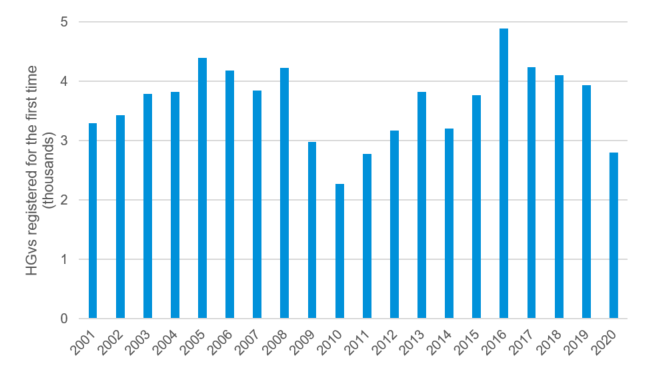

- The number of HGVs registered for the first time in Scotland reduced in 2020. Data shows there has been a reduction in new registrations year on year since 2016, with 2020 recording the lowest number of registrations since 2011

- Maximum daily mileage per HGV is estimated to vary between 400 to 800 km/day, with large articulated trucks covering a maximum of between 600 and 800 km/day

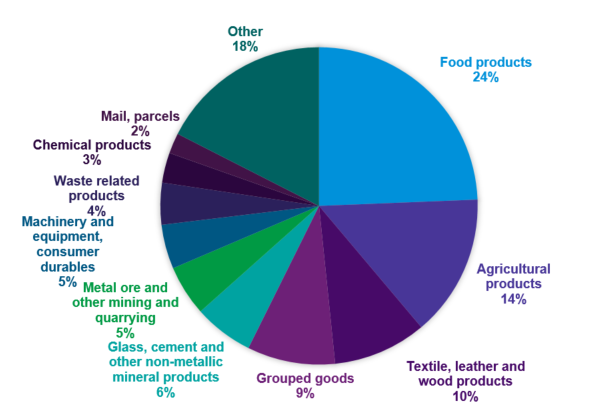

- Food products, including beverages and tobacco, were the most common type of freight lifted and remaining in Scotland in 2020

- Over 40% of HGV GHG emissions are estimated to come from large articulated trucks as they make up a large proportion of the fleet and have the highest mileage

- Large and Very Large Rigid vehicles combined are estimated to emit approximately 40% of all HGV GHG emissions. The proportion of very large rigid HGVs as part of the overall Scottish fleet has increased in recent years

- The proportion of Small Rigid HGVs as part of the overall Scottish fleet has decreased slightly in recent years. They contribute around 9% of HGV GHG emissions, even though they make up over 20% of the fleet.

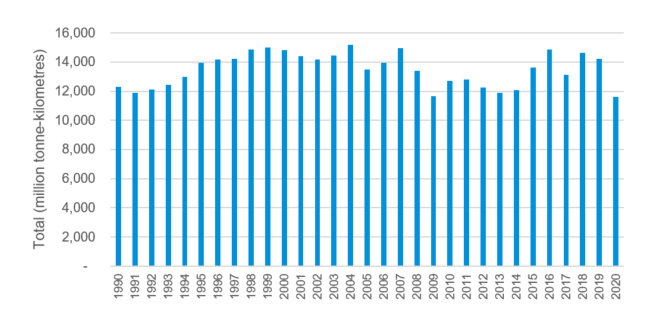

Origin and destination of goods

In 2020, 11.6 billion tonne-kilometres of freight originating in Scotland was transported to all destinations, of which 64% (7.9 billion tonne-km) remained within Scotland, 34% was transported to other parts of the UK and 2% to outside of the UK. The overall total was an 18% decrease compared to 2019 figures (Scottish Transport Statistics no 40 - 2021 Edition Chapter 3: Road Freight).

In 2020, 13.2 billion tonne-kilometres of freight lifted by UK HGVs was transported to destinations in Scotland, of which 57% (7.4 billion tonne-km) originated in Scotland, 42% originated in other parts of the UK and 1% originated outside of the UK. The overall total was a 11% decrease compared to 2019 figures.

Table 1 provides an overview of the origins and destinations of freight originating and arriving in Scotland (in million-tonnes). The Regional Transport Partnership areas are used to define areas within Scotland. Data from 2016-2020 shows that the majority of goods transported by UK registered HGVs that stayed within Scotland tended to start and finish their journeys within the same region. It is noted this data is available as an average year between 2016 and 2020 only so the figures may vary from the totals stated for 2020.

| - | Journey Ended In | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Journey Started In | Shetland | Highlands and Islands | North-east | Tayside | South-east | Glasgow and west | South west | Scotland | Elsewhere in UK | Total |

| Shetland | 263 | * | * | * | * | * | * | 265 | * | 265 |

| Highlands and Islands | * | 10,798 | 531 | 191 | 175 | 457 | * | 12,184 | 1,805 | 13,989 |

| North-east | * | 650 | 8,767 | 232 | 317 | 298 | * | 10,294 | 1,398 | 11,692 |

| Tayside | * | 228 | 346 | 1,885 | 681 | 681 | 49 | 3,870 | 551 | 4,421 |

| south-east | * | 328 | 492 | 522 | 9,956 | 1,844 | 326 | 13,469 | 1,605 | 15,074 |

| Glasgow and west | * | 400 | 392 | 434 | 1,865 | 12,238 | 490 | 15,819 | 2,332 | 18,151 |

| South west | * | * | * | 226 | 181 | 381 | 1,798 | 2,644 | 1,339 | 3,983 |

| Scotland | 266 | 12,463 | 10,529 | 3,491 | 13,175 | 15,899 | 2,722 | 58,544 | 9,030 | 67,574 |

| Elsewhere in UK | * | 1,924 | 2,112 | 533 | 2,372 | 2,991 | 1,352 | 11,284 | 1,358,725 | 1,370,009 |

| Total | 266 | 14,387 | 12,641 | 4,023 | 15,547 | 18,890 | 4,073 | 69,828 | 1,367,755 | 1,437,583 |

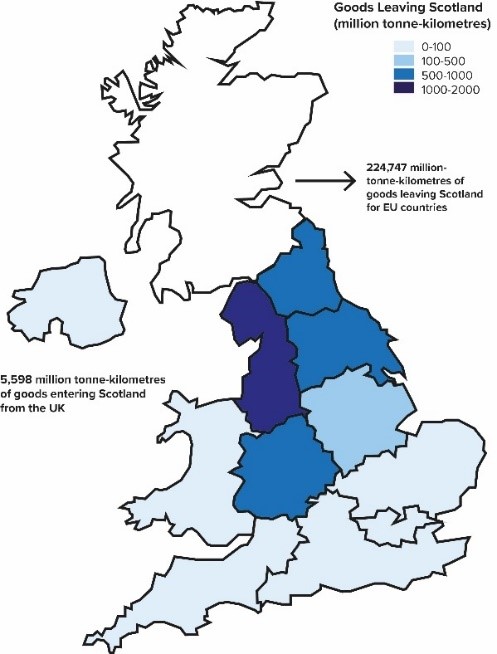

Further information on the origins and destinations of goods transported elsewhere in the UK is provided in Figure 2. This diagram illustrates that most goods leaving Scotland are being transported to the north-west of England (31%), Yorkshire and Humber (19%), West Midlands (13%) North-east England (13%). A comparison of this data with goods arriving in Scotland shows a similar pattern for origin (Scottish Transport Statistics no 40 - 2021 Edition Chapter 3: Road Freight).

The amount of international road freight transported by UK HGVs to and from Scotland was less than 1 million tonnes, with top origins and destinations including Belgium and Luxemburg, France, Germany and the Netherlands (Scottish Transport Statistics no 40 - 2021 Edition Chapter 3: Road Freight).

Age of HGV Fleet

The average age of HGVs across Europe is increasing (ACEA (2022). The Automobile industry Pocket Guide 2021/22). This is supported by anecdotal evidence from interviews conducted in the UK by the BVRLA which found that UK operators are sweating their vehicle assets more than before (BVRLA (2020) Industry Outlook Commercial Vehicles in association with Motor Transport).

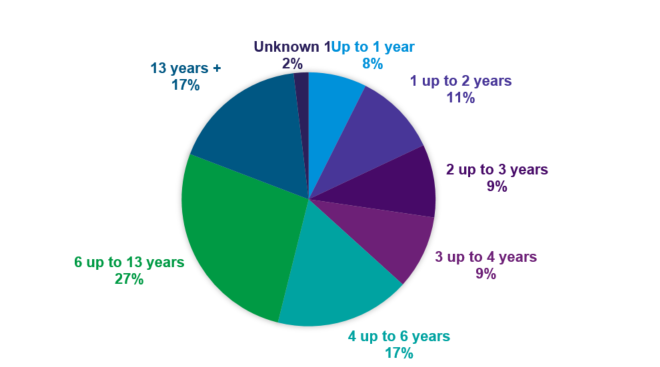

In Scotland at the end of 2019, the average age of vehicles taxed to carry goods (Time since first registration not manufacture date) was 6.5 years. This has increased from 5.8 years in 2000 (Scottish Transport Statistics no 40 - 2021 Edition Chapter 1 Vehicles). However, data for the UK reveals that around 17% of HGVs are over 13 years old (DfT Vehicle Licensing Statistics). The largest HGVs are assumed to be on our roads between four and seven years. Smaller vehicles, have longer average lifespans of between six and 14 years (Consultation on when to phase out the sale of new, non-zero emission heavy goods vehicles).

During the stakeholder engagement workshop operators stated that older vehicles (after five or six years) often go into the rental market and that this is a critical component of the leasing business model.

Licenced Operators

There are 5,592 HGV licence holders in Scotland. Around 90% of licence holders have ten vehicles or less registered on their licence and 8% have between 11 and 50 vehicles registered. Based on this same data, it is estimated that around 2% of licence holders operate over 35% of vehicles (Scottish Transport Statistics no 40 - 2021 Edition Chapter 1 Vehicles).

In Scotland, companies operating on a restricted licence (and therefore can transport their own goods only) make-up almost half of companies moving goods by HGV but operate only a quarter of vehicles (Scottish Transport Statistics no 40 - 2021 Edition Chapter 1 Vehicles).

According to a BVLRA vehicle rental and leasing companies are responsible for 20% of trucks on UK roads (BVRLA (2020) Industry Outlook Commercial Vehicles in association with Motor Transport).

Whilst most operators in Scotland work across the central belt, many are also operating on country and unclassified roads (Scottish Wholesale Association (2021), Decarbonisation of the Scottish Wholesale Industry: Creating a Green & Sustainable Local Food & Drink Supply Chain. Fleet Emissions Baseline).

Many Scottish business involved in freight run on low profit margins, for example SWA reporting an average (pre covid) net margin of 1.3% for the wholesale sector (Scottish Wholesale Association (2021), Decarbonisation of the Scottish Wholesale Industry: Creating a Green & Sustainable Local Food & Drink Supply Chain. Fleet Emissions Baseline).

Supply Chain

There are currently no large established OEMs in Scotland and one bus and coach manufacturer, Alexander Dennis. The four UK commercial vehicle manufacturers (Dennis Eagle, London Electric Vehicle Company (LEVC), Leyland Trucks and Vauxhall) exported almost 60% of their production, with almost all of this going to the EU (SMMT-Facts-November-2021).

For HGV manufacturers registered in the UK, DAF (These are also branded as Leyland.) trucks accounted for over 30% of all HGVs registered in 2020, followed by SCANIA (14.2%), VOLVO Trucks (13.5%) (Mott MacDonald calculations based on vehicle registration data from DfTHeavy Goods Vehicle registrations by quarter – from source 19 SMMT).

Additional details on the supply chain will be provided as part of a future paper presented to the Taskforce.

Potential approaches for achieving decarbonisation

Overview

The Transport model for Scotland (TMfS) forecasts demand for goods vehicles to increase by approximately 20% between 2019 and 2030, and 50% between today and 2045.

(The Transport Model for Scotland is a strategic transport model, which provides a broad representation of transport supply and estimates of transport demand. More details of the TMfS forecasts can be found here: Transport Scotland, 2018, Transport Forecasts 2018.)

This growth is primarily driven by vans with only a small proportion expected to come from trucks, 1% and 6% by 2030 and 2045 respectively (Element Energy (2021), Decarbonising the Scottish Transport Sector. Report for Transport Scotland). Decarbonisation of HGVs can be achieved through several mechanisms: powertrain/fuel technology; operational change within industry; modal shift; and wider behaviour change by producers and consumers. Logistics is not an end in itself, but the haulage and logistics sector transports the goods that consumers demand and producers supply

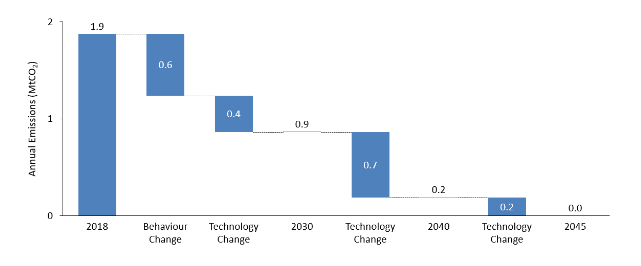

To achieve Scotland’s emissions reduction targets for the transport sector by 2030 and achieve net-zero by 2045, it is estimated that all these mechanisms will be needed with 23% of tonne-km shifted to rail and ships by 2030 and a 15% reduction in tonne-km transported by HGVs by 2030 due to operational changes (Element Energy (2021), Decarbonising the Scottish Transport Sector. Report for Transport Scotland). As shown in Figure 3, technology could account for more than two-thirds of truck emission reductions needed by 2045.

Current knowledge on the role of technology (including infrastructure) in achieving decarbonisation are summarised the following sections. As previously specified, modal shift and wider behaviour change, such as reduction in packaging of goods, fall out of scope for this Taskforce and therefore this paper.

(Source Element Energy: note behaviour change includes modal shift)

Technology

Types of technology

The zero emission truck market is at an early stage of development and technological solutions for all use cases (range and weight) are not yet available. There are four types of vehicle powertrain technologies that could potentially contribute to the pathway to zero emission trucks. Technology readiness is considered in more detail in Paper 2 with a summary provided below.

Battery electric trucks (BET)

BET technology is currently limited in terms of its application to heavy weight loads and distances more than around 400 km in one charge in test conditions. This makes battery technology in general not yet fully fit-for-purpose for all freight movements in Scotland. However, trials are ongoing with higher ranges expected to become available in the short to medium term. Public infrastructure for BET is currently not yet widely available and ease of upgrading depot infrastructure varies.

Hydrogen based fuel cell electric trucks (FCET)

FCET can accommodate the higher weight load and longer distance requirements but rely on the availability of hydrogen refuelling infrastructure which is currently not yet widely available. However, Hydrogen fuel cell trials have been undertaken in Europe since 2016 with trials expected to continue to 2024 (Roland Berger (2020), Fuel Cells Hydrogen Trucks Heavy Duty's High Performance Green Solution). These have covered both rigid and articulated trucks and involved a range of vehicle manufacturers, fuel cell providers and operators.

Electric road systems (ERS)

ERS rely on significant infrastructure in the form of an overhead catenary system, in addition to the truck technology. Neither are currently available in the UK although trials have been conducted overseas and recently funded in northern England under the DfT’s Zero Emission Road Freight Trials (ZERFT) (Road freight goes green with £20 million funding boost - GOV.UK).

Low carbon fuels (LCF)

Emission reductions (but not zero tail pipe emissions) can also be achieved from low carbon fuel alternatives, such as biofuels or electrofuels (e-fuels). LCF trucks are broadly similar to ICETs in terms of range and refuelling times and are operating now in Scotland. LCF are often described as a transition option due to potential supply issues and the potential need for their use for other transport modes (for example aviation).

These technologies are discussed in more detail in Paper 2.

Progress to date

Many large shippers of goods, energy companies and retailers have made commitments to decarbonise their fleets. For example, multiple British companies including BP, BT, Direct Line Group, Royal Mail, Scottish Power, Severn Trent and Tesco pledged to electrify their fleets by 2030 (Electrive (2021) Seven British companies pledge to electrify fleets by 2030). Both Amazon and Tesco currently have small numbers of BET in use in the UK and ambitious decarbonisation targets, while John Lewis Partnership is trialling an integrated depot, public network and home charging scheme for their 350 vehicle Home Services Fleet.

Specifically in Scotland, the SWA has set out a pathway for the sectors vehicle fleet. Scottish Transport and Logistics provider John G Russell Transport is working with hydrogen fuel-cell truck manufacturer Hyzon Motors to facilitate the deployment of FCET in the UK. The Scottish public sector has also committed to phase out the need for any new petrol or diesel HGVs in their fleets by 2030.

Several European truck manufacturers have made commitments to zero emission fuels, both electric and hydrogen, and begun to form collaborations with partners to accelerate the shift. BET are already commercially available from Renault trucks (part of the Volvo group), Scania and DAF, for example, with commitments to extend these to long distance trucks. Scania is also involved in the development of ERS and has some hydrogen trucks in operation. Other European HGV manufacturers, including Daimler Trucks and the Volvo Group, have also formed joint ventures such as cellcentric and H2Accelerate to support the roll-out of hydrogen trucks, while DAF is trialling this technology. In addition, start-up companies such as TEVVA and HVS are developing and trialling BET and hydrogen technology.

The existing and future deployment of ZETs will be discussed in more detail in a future paper on the vehicle supply chain.

Infrastructure

Availability of charging and refuelling infrastructure is a key element in future deployment of zero emission technology. Infrastructure and energy requirements differ according to the various technology options.

BETs require 150kW chargers as a minimum and there are currently only around 82 150kW or above public charger devices in Scotland (as of Feb 2022) (ZapMap, 2022), with none further north than Inverness. Charging infrastructure is currently provided by a mix of the public and private sectors with no coordinated delivery plan.

There are currently only four public hydrogen refuelling stations in Scotland. Two are in Aberdeen, one is in Orkney, and one is in the central belt of Scotland, outside of Edinburgh. Plans for further hydrogen refuelling stations are in development including a two-acre site in Bridge of Don in Aberdeen.

As noted above, there are currently no ERS in Scotland or the UK, although the feasibility of UK trials is currently being explored through the ZERFT fund.

Additional detail on infrastructure requirements will be provided in a future infrastructure focussed Paper.

Industry stakeholders

Industry overview

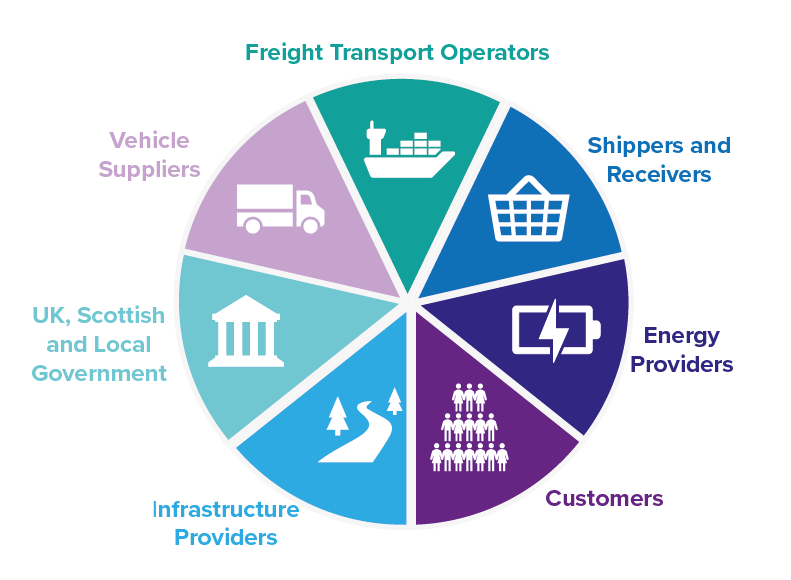

There are several stakeholders, in addition to freight and logistics operators, that influence the transport of goods by HGVs and that may play a role in the pathway to their decarbonisation. These are presented in Figure 4 and described in more detail below.

(source: based on MDS Transmodal (2019), Understanding the UK Freight Transport System).

Shippers/receivers

Are the organisations who own the goods being moved. They both operate their own fleets (transporting around 45% of road freight lifted in the UK) and outsource this transport to freight transport operators.

Shippers may both stimulate consumer demand for lower emission transport or respond to consumer pressure to use these technologies and provide incentives to logistics providers and hauliers to do the same (MDS Transmodal (2019), Understanding the UK Freight Transport System), (Scottish Wholesale Association (2021), Decarbonisation of the Scottish Wholesale Industry: Creating a Green & Sustainable Local Food & Drink Supply Chain. Fleet Emissions Baseline).

Receivers could have a role in reducing emissions through enabling route optimisation through being flexible with delivery times.

Freight transport operators

Include both hauliers and 3rd party logistics organisations (3PLs). 3PLs provide a range of supply chain services to shippers and hauliers and are likely to own warehousing facilities and vehicles. Freight brokers can also be included in this group although they differ from 3PLs in that they only match shippers to hauliers and do not transport goods. Freight transport operators have a pivotal role in decarbonisation through their uptake of technology and opportunities for operational change.

Vehicle suppliers

Comprise OEMs that manufacture vehicles, manufacturers of components (particularly powertrains) as well as vehicle leasing companies. New business models, such as Novuna Vehicle Solutions, TRATON and other OEMs look to extend this towards ‘trucks as a service’ (TaaS) and include design and build as well as leasing (ALICE Roadmap to Physical Internet released! (etp-logistics.eu)), (Leasing for HGV & Van Fleets | Novuna Vehicle Solutions). Vehicle suppliers will be important in the development, cost and at-scale production of zero-emission trucks (Shell-Deloitte (2021), Decarbonising Road Freight: GETTING INTO GEAR Industry Perspectives), including through investment and participation in trials.

Energy providers

Currently supply diesel and its refuelling infrastructure for almost all HGVs; 96.5% of new trucks in the EU were still fuelled in this way in 2020 (Lambert et al. (2021), Contrasting European hydrogen pathways: An analysis of differing approaches in key markets. IES PAPER: NG 166). Moving to large scale adoption of zero-emission trucks will require the involvement of additional energy providers such as the electricity network operators (who are tightly regulated by the UK government) and hydrogen producers. There is a requirement to scale up production and distribution of renewable electricity and hydrogen and the provision of corresponding refuelling/recharging infrastructure.

Government

At all levels has a key role in setting the framework in which industry operates, including through policy direction, fiscal measures to incentivise behaviour, regulation. It may also directly provide or legislate for infrastructure.

Private investors

Are likely to play an increasingly significant role, for example through the provision of charging infrastructure and new business and delivery models. There is some blurring of boundaries between investors and suppliers with companies like NeoT and Novuna offering financing solutions.

Academia

Supports the future of the freight sector through research and development (R&D).

Views from industry

Industry stakeholders will play a key role in and can influence the pathway to ZETs; their viewpoints are therefore important. These views have been obtained from published position papers, reports and news articles from organisations directly or through industry bodies. They reflect the current positions and opinions of stakeholders that operate in Scotland, the UK and Europe on the challenges, opportunities and practical ways forward in the decarbonisation process. These published views were supplemented by a workshop aimed at engaging SMEs and companies working in remote or rural locations.

These industry views do not always reflect Scottish Government policy or the impact of the extent of powers devolved to the Scottish Government. Where solutions or opinions offered are outside of the scope of the Taskforce for these reasons this has been noted in the following sections.

Challenges

Industry groups raised several challenges which acted as barriers to the transition to alternative fuels.

Lack of available and accessible information was raised as a key challenge in the workshop. This includes lack of knowledge on available technologies as well as the application of technologies in real world operation settings relevant to them including different geographies and weather conditions. There was a strong message from operators that solutions need to align with their needs. Language used to describe new energy infrastructure and requirements is often dense with jargon and could be presented with greater clarity.

A common fear was that of “stranded assets”, which presents one of the biggest risks associated with decarbonisation, in which new regulations are implemented part way through the asset-life cycle of a vehicle and subsequently prematurely end the lifetime of vehicle (As noted in Section 2.2, the average age of HGVs in 2020 is 6.5 years in the UK, with around 17% over 13 years old). Furthermore, ZETs are still at an early stage of development, and there is still a high level of uncertainty as to which fuel type is most appropriate, with differing views on hydrogen, electrification and electric road systems, which creates confusion across the industry as to when and what to invest in (Logistics UK, The Route to Net Zero Logistics). In addition, some stated that fleets which have already invested in low carbon fuels may be reluctant to trial new zero emission technologies due to the lifecycles of their existing fleet (BVRLA (2022), BVRLA fleet charging guide 2022).

Feedback from stakeholders attending the workshop was that their preference would be to invest in zero emission technology, as opposed to transition fuels given HGV lifespan and costs. However, vehicle turnover would mean that decisions regarding which technology to invest in would need to be made as early as 2025 if all new HGVs sold in the UK are to be zero emission by 2040 and the lack of knowledge was making this very difficult.

Infrastructure was also highlighted as a barrier to the uptake of ZETs with the SMMT noting the need for a dedicated public HGV charging network. Currently, only operators who run a back to base model and can afford to invest in depot infrastructure can transition to electric vehicles. This was a significant concern raised by SME operators in the workshop as a lack of public charging/ refuelling infrastructure in rural and remote areas could make some businesses unviable.

The impact on the HGV leasing market was raised as a concern during the workshop. According to a BVLRA survey, less than half of UK operators own their own vehicles, with 14% using a short-term (6 to 12 months) rental or lease (BVRLA (2020) Industry Outlook Commercial Vehicles in association with Motor Transport). During the workshop operators stated that older vehicles (after 5 or 6 years) often go into the rental market and that this is a critical component of the leasing business model. If vehicle owners delay purchases too close to the 2040 deadline, there may be a period of time where there are no zero emission trucks available for lease. This needs to be considered as part of the decarbonisation pathway.

Vehicle manufacturers raised concerns regarding the durability of some solutions, such as hydrogen FCET, which needs to be improved to reach the operational lifespan requirements of operators, including in the second-hand market. As such, manufacturing methods need to be improved and OEM consensus is needed on standardisation e.g., hydrogen tanks and nozzles, whilst the cost of compression is another key challenge. Depot workshops would also need to invest to cope with electric and hydrogen vehicles alongside diesel (SMMT (2022), Delivering consumer-centric charging infrastructure for zero emission mobility).

In general, there is a lack of consensus across the various relevant industries on the relative costs of different technologies. Cost and functionality were highlighted as significant barriers to decarbonisation, including the cost of supporting infrastructure, especially with some industries, such as wholesale, operating on small margins (RHA (2021), Decarbonising the commercial vehicle fleet – Eliminate, minimise, offset), (Logistics UK, The Route to Net Zero Logistics), (BVRLA (2022), BVRLA fleet charging guide 2022s). The move to alternative vehicles needs to be comparable to existing TCO and performance levels. For instance, electric trucks currently on the market are more expensive than their diesel counterparts, therefore without government grants to support the transition purchasing costs remain a barrier (RHA (2021), Decarbonising the commercial vehicle fleet – Eliminate, minimise, offset). In addition, members of the SWA who have investigated alternative technologies, predominantly electric, identified initial cost as a primary barrier in addition to currently limited mileage range and lack of charging infrastructure outside of their depot. The residual value of new technologies was also raised as a concern in the workshop.

Industry representatives also highlighted the lack of existing scalable technology to cover all the requirements of larger vehicles on the market (RHA (2021), Decarbonising the commercial vehicle fleet – Eliminate, minimise, offset). In a survey undertaken in May 2021 by Logistics UK, almost 70% of respondents were dissatisfied with the availability of electric HGVs, compared to 37% for vans. BVRLA (the representative body for rental and leasing firms), undertook a survey of its members in 2021, who represent over 970 companies and are responsible for 100,000 HGVs, to understand industry views on commercial vehicles on a range of topics, one of which was decarbonisation. Whilst there was a clear demand for electrification in the van sector, with all interviewees trialling electric vehicles, compressed Natural Gas (CNG) and LNG were seen as the only immediately viable alternatives to diesel for trucks, with hydrogen seen to have potential in the long-term. Many interviewees noted they believed Euro-6 trucks were still the only safe bet and provided certainty, whilst much uncertainty existed about future generations of trucks (BVRLA (2020) Industry Outlook Commercial Vehicles in association with Motor Transport). While this suggests an appetite for transition, there is further to go before procurement at any scale can begin.

Opportunities / Solutions

There were some common themes in industry views on the solutions and opportunities for decarbonisation.

A range of solutions, rolled out over different timescales will be needed to suit the multitude of customer needs and use-cases. There is no ‘”one size fits all” approach for the decarbonisation of HGVs which can be rolled out, and such approaches will not be effective and could instead be counterproductive (Shell (2021), Decarbonising Road Freight: SHELL’S ROUTE AHEAD). In particular there is a concern that rural and specialist applications have not been sufficiently embedded in Government thinking.

A key opportunity in the sector is for innovation in technology and trials to test the readiness of technology. This would be welcomed by industry groups, with around 70% of SWA members willing to participate in tests and trials of technologies (Scottish Wholesale Association (2021), Decarbonisation of the Scottish Wholesale Industry: Creating a Green & Sustainable Local Food & Drink Supply Chain. Fleet Emissions Baseline).

Low carbon fuels were seen as part of the solution in the transition to zero emissions by industry representatives. These include biomethane and hydrotreated vegetable oils (Logistics UK, The Route to Net Zero Logistics), bioenergy (Food and Drink Federation, Achieving Net Zero: A Handbook for the Food and Drink Sector) and other low carbon fuels produced from biogenic and waste feedstock. LNG is also seen as an intermediary solution as it can reduce GHG emission by up to 22% compared to conventional diesel heavy duty engines (Shell (2021), Decarbonising Road Freight: SHELL’S ROUTE AHEAD). The RHA goes further and proposes a sustainability hierarchy - Eliminate, Minimise, Offset – in which offsetting needs to be a priority solution whilst more permanent low carbon / zero carbon solutions are developed (RHA (2021), Decarbonising the commercial vehicle fleet – Eliminate, minimise, offset). It is noted that this is not consistent with current Scottish Government policy. In addition, given refrigeration adds 15-20% to vehicle emissions, refrigeration units could be electrified earlier than engines to reduce emissions in the short-term (Food and Drink Federation, Achieving Net Zero: A Handbook for the Food and Drink Sector).

The requirement for investment now in energy infrastructure and support to align with demand was noted, with BET and hydrogen the technologies leading the transition to ZETs (Shell (2021), Decarbonising Road Freight: SHELL’S ROUTE AHEAD). The European Automobile Manufacturers’ Association (ACEA), alongside the energy, electric and charging infrastructure industries are calling for higher investment in charging and refuelling infrastructure, a market-based approach, financial incentives, co-funding and mandatory targets to ensure a minimum network becomes available in all EU states.

An opportunity for manufacturers to locate production on green hydrogen sites in the future was also identified (Food and Drink Federation, Achieving Net Zero: A Handbook for the Food and Drink Sector).

There are also opportunities within Scotland given its strong capabilities in several niche vehicle manufacturing sectors, especially in emergency rescue, construction and agriculture applications, and the existing Scottish hydrogen clusters which presents an opportunity to develop local supply chains to service them (Zero Emission Mobility Industry Advisory Group - HDV/Innovation Workshop - 5 October 2021). Similarly, there is an opportunity for new skills to be learnt with new technologies.

Practical tools to help

Across industries there is a call for a clearer pathway for the decarbonisation of HGVs. In particular, the pathway should be built upon credible evidence and align with technological innovation and vehicle lifetime cycles (RHA (2021), Decarbonising the commercial vehicle fleet – Eliminate, minimise, offset).

Industry representatives argue there also needs to be coordination between the UK Government, devolved powers and local authorities to ensure a clear policy and pathway to decarbonisation (RHA (2021), Decarbonising the commercial vehicle fleet – Eliminate, minimise, offset). For example, more than 90% of the global stock of electric buses and trucks are in China, with 20,000 zero emission trucks and utility vehicles sold in 2019. This is partly attributed to targeted policy efforts at the national and local level.

The need for environmentally ambitious but realistic and achievable phase out dates for diesel HGVs was also a concern for Logistics UK (Towards-zero-emission-transport_Cross-industry-call-for-action.pdf (acea.auto)), (Commercial vehicle industry calls for decarbonisation plans before bans - SMMT). They also need to allow the freight sector to adequately prepare for the transition to ZETs in a cost effective and efficient manner (Shell (2021), Decarbonising Road Freight: SHELL’S ROUTE AHEAD). A HGV delivery plan to guide the decarbonisation of the freight sector, which also provides clarity on weight derogations of HGVs and timelines, would be beneficial (BVRLA (2022), BVRLA fleet charging guide 2022). It is noted that policy such as phasing out dates for sale of new ICE vehicles is not within the power of the Scottish Government.

The need for government intervention to help facilitate the market introduction of cleaner HGVs was raised by many groups xvii. For example, investment in public refuelling / recharging infrastructure through grants or incentives could in turn help stimulate the uptake of zero emission vehicles. Such a trend can be seen in the passenger market, which has a larger number of vehicles than the HGV sector and provided confidence in the adequacy of infrastructure (Joint Research Centre (JRC) (2021), Decarbonisation of Heavy Duty Vehicle Transport: Zero emission heavy goods vehicles). Government financial incentives in vehicle manufacturing was also raised (Shell (2021), Decarbonising Road Freight: SHELL’S ROUTE AHEAD), although this may be less relevant to Scotland due to the lack of established OEMs.

As HGVs cross national boundaries, a need was seen for a harmonised approach across regions, such as the EU, and to have international / national standards for vehicles and supporting infrastructure (Joint Research Centre (JRC) (2021), Decarbonisation of Heavy Duty Vehicle Transport: Zero emission heavy goods vehicles). It is noted that this is not within existing Scottish Government powers.

SWOT Analysis

Decarbonising HGVs as part of Scotland’s ambitious emission reduction targets for the transport sector presents several challenges. Building on the evidence from the previous sections, a SWOT analysis is used to identify Scotland’s strengths and weaknesses in relation to achieving zero-emissions HGVs and the associated barriers and opportunities.

Strengths

Ambitious and wide ranging Climate Change targets

Scotland has set ambitious Climate Change objectives that send a strong signal of intent to all sectors of the Scottish economy and individuals. This has been accompanied by its commitment to fairness through the Just Transition. A coherent approach is being adopted to achieving these goals; this is evidenced by the consideration of the inter-relationship between transport and energy in the Scottish Hydrogen Assessment and energy strategy. In its taskforce initiatives, Transport Scotland also recognises that a wide range of stakeholders need to be engaged in the decarbonisation of transport.

Existing niche HGV and bus manufacturers experience

The HGV market is relatively small compared to car and van markets. Scotland can draw on its existing experience of decarbonisation of buses, bus manufacturing capability, and work done to support the decarbonisation of niche heavy duty vehicles to inform its approach to the HGV market (Zero Emission Mobility Industry Advisory Group - HDV/Innovation Workshop - 5 October 2021).

Engaged industry stakeholders

There is evidence of a high level of engagement from industry stakeholders in decarbonisation, particularly from food and agriculture, which are the largest sectors in terms of goods moved in Scotland. Decarbonisation of non-HGV fleet segments is already taking place and some food retailers are introducing BETs in other parts of the UK. In Scotland, 70% of SWA members would be willing to participate in trials and the Food and Drink Federation (FDF) has CO2 reduction ambitions across a range of areas including transport. Stakeholders also attending the workshop also reiterated an enthusiasm for transitioning to zero emission trucks.

Availability of renewable energy for zero emissions technology

Deployment of zero-emission technology relies on the availability of green energy at a competitive cost. Scotland is well placed as renewables provided the equivalent of 98.6% of Scotland’s gross electricity consumption in 2020. There are plans in action to increase the supply of renewables further. As set out in the Hydrogen Assessment and policy statement, there is abundant opportunity for green hydrogen production, and there is significant commercial interest and activity underway to realising this potential. A report due to be published shortly by Transport Scotland (Zero Emission Energy for Transport Forecasts) shows that the amount of electricity and hydrogen the transport system is expected to need (out to 2045, to meet emission reduction targets) is well within the limits of what the Scottish energy sector is expected to generate.

Strong R&D sector

Scotland has demonstrable R&D expertise across all the zero-emission technologies that could contribute to the decarbonisation of transport, alongside experience from trials and decarbonisation of other HDVs.

The Logistics Research Centre at Heriot Watt University is part of the Centre for Sustainable Road Freight (SRF) which brings together three of the UK’s leading academic groups. The SRF has undertaken research into decarbonising road freight as quickly and economically as possible, whilst also minimising energy consumption. The Hydrogen Accelerator is a partnership between the University of St Andrews and the University of Strathclyde that provides technical and project management support and advice to accelerate the deployment of projects at scale and has a role in the Low Carbon Applications Test Centre (LOCATE) power train test facility which will be established at the Michelin Scotland Innovation Parc (MSIP). Both LOCATE and the Power Networks Demonstration Centre at the University of Strathclyde have been funded by Transport Scotland. The Hydrogen Accelerator also developed a prototype FCEV refuse collection vehicle with Glasgow Council as part of its HGV fleet decarbonisation.

Weaknesses

No established HGV manufacturers located in Scotland

HGVs in the UK are currently mainly supplied by European manufacturers, with the market leader, DAF, also manufactured by one of the UK’s four commercial vehicle manufacturers, although none of these are located in Scotland.

The lack of manufacturing capacity could mean that Scotland is dependent on supply from outside its borders, which could reduce its ability to generate a market for zero-emission HGVs and mean the deployment of these vehicles could be determined by supply availability rather than operator needs.

Fragmented freight sector

There are a significant number of SMEs transporting freight by road in Scotland; Around 90% of licence holders have ten vehicles or less registered on their licence and 8% have between 11 and 50 vehicles registered. Based on this same data, it is estimated that around 2% of licence holders operate over 35% of vehicles (Scottish Transport Statistics no 40 - 2021 Edition Chapter 1 Vehicles). The large proportion of small freight operators make it harder to invest in technology and make efficiency improvements. The variety of operators and large rural areas to be reached also means that there is a need for range of powertrain/refuelling options for a relatively small sector.

Influence of actors outside Scotland on decarbonisation pathways

There is a high proportion of freight movements into Scotland from operators based elsewhere in the UK and vice versa. The adoption of technology and infrastructure in Scotland will be influenced by UK government policy, which in turn will need to align with European neighbours, particularly in France and Germany, given the need for refueling during trips to those countries. It will also be affected by industry wide agreements on standards and recharging protocols.

Limited policy levers to engender change

The UK government is responsible for setting taxes in the transport sector (with the exception of aviation), which could influence the relative cost of different technologies in comparison to diesel. It will also determine when fossil fuel technologies are phased out. The deployment of FCETs and BETs may rely on changes to vehicle design standards that allow them to be longer and heavier to support the use of batteries and hydrogen tanks (Element Energy (2021), Decarbonising the Scottish Transport Sector. Report for Transport Scotland), (Joint Research Centre (JRC) (2021), Decarbonisation of Heavy Duty Vehicle Transport: Zero emission heavy goods vehicles). Vehicle design standards also fall within the remit of UK government. However, the Scottish government can incentivise behaviour through investment and other forms of regulation, as has been demonstrated through its investments in R&D, and through local authority spending on decarbonisation. It can also adopt a policy leadership and convening role.

Opportunities

Take simple action on operational change

Evidence on decarbonisation pathways indicates there is a need to act on operational change before technological solutions or system wide efficiency improvements are able to be deployed on a large scale. Supporting retrofitting with aerodynamic/rolling resistance features and operator/driver upskilling could be a quick way to make progress.

Trials/demonstration projects

There is a lot of uncertainty within industry about the decarbonisation pathway and trials can provide evidence based information to industry to allay this. Scottish local authorities have already taken part in hydrogen trials for refuse collection vehicles and there are various trials for both BET and FCET under development, including one funded by DfT. Once information is available there is significant opportunity to help share this information within relevant sectors, to ensure SMEs have access to the same information as larger operators.

Production of zero-emissions technology in Scotland

Although there are no established HGV manufacturers in Scotland, decarbonisation is an opportunity to support the production of zero emission vehicles and components, drawing on experience from other HDVs and R&D capability. Funding to progress HGV designs to the prototype stage has already been secured by one start-up. Given the role of the UK and other external actors, there could be an opportunity to leverage technology developed elsewhere for some use cases and focus internal efforts on a specific technology. Lessons learnt from the expansion of renewable energy, particularly in relations to jobs for the Scottish economy, could be applied here, also given the increased demand for green energy to supply the transport sector.

New jobs and skills through infrastructure provision

There are significant opportunities for new skills and jobs through the provision of the required recharging/refuelling infrastructure including provision, repair and maintenance.

HGV demand aggregation

At the same time as supporting a nascent zero-emissions technology industry, Scotland will need to overcome the lack of OEMs and mitigate against supply issues, particularly in the short term. One option would be to take the approach of New Zealand or Switzerland (Element Energy (2021), Decarbonising the Scottish Transport Sector. Report for Transport Scotland) and explore aggregating demand to place larger orders, although this would still need to consider the needs of multiple use cases.

Cross-sector collaboration - Infrastructure provision

The possibility of sharing the costs and risks associated with the provision of depot recharging/refuelling infrastructure could also be explored.

New financing models

Costs are a key driver for freight operators that will influence their investment in zero-emissions vehicles. Uncertainty is also seen as a key barrier to take-up. Survey data from the BVLRA indicates that there is increasing interest in leasing vehicles, particularly on short term leases that could reflect uncertainty from a range of sources including Brexit and more recent conflict. New financing models could provide more certainty and more affordability for operators that could increase deployment of zero-emission vehicles.

Threats

Uncertainty over the technologies that will be used to decarbonise HGVs

Uncertainty across industry could lead to delays in investment by operators and vehicle and infrastructure suppliers.

Total cost of ownership of zero-emission vehicles

A currently high TCO for ZETs and uncertainty over which technology will dominate may lead to existing ICE vehicles being used for longer. There are also fears of having “stranded assets” in which regulations are implemented part way through existing vehicle lifecycles thus prematurely ending their lifetime.

Lack of supply of zero-emission vehicles to meet demand

Delays in deployment of infrastructure and vehicles by the suppliers of these technologies may result from uncertainty about which technology will dominate or from lack of materials, components and skilled labour needed in production. Providing incentives to operators to switch to zero-emissions vehicles to achieve carbon reduction targets could lead to demand exceeding supply.

Impact on the HGV leasing market

There is currently strong reliance on the HGV leasing market. The leasing business model could be significantly disrupted by a lack of available second hand zero emission trucks if HGV owners delay purchasing decisions to close to the 2040 deadline.

Availability of suitable sites for infrastructure

All charging, refuelling infrastructure needs access to a grid connection of suitable capacity combined with land and associated planning permission at a suitable location adjacent to the road network. There is currently no overall strategy for the provision of this infrastructure and it is therefore unclear if sufficient sites are available.

Shift from HGVs to vans

Much of the forecast growth in goods transport is forecast to be by vans but there is a lack of data on van payloads, particularly for urban deliveries (Cherrett T and J Allen (2019), Last mile urban freight in the UK: how and why is it changing? Future of Mobility Evidence Review. Foresight, Government Office of Science). The greater level of technological readiness of zero emissions technology for LGVs and the potentially higher cost of decarbonising HGVs could lead to more goods being transported by vans. This could have implications for congestion.

Other uncertainties

The climate change emergency is occurring alongside huge challenges from Brexit, the Covid pandemic and war in Ukraine. There is a risk that the freight industry is not able to resource the changes needed to decarbonise and the decarbonisation pathways needs to take account of current and future unknown challenges.

Other technological uncertainties

Other technologies such as autonomous vehicles and the physical internet may offer further opportunities to reduce emissions. However, the potential deployment of these technologies in the same timeframe as zero-emission vehicles could lead to further uncertainty about which vehicle types to invest in and also has an impact on cost.

Appendix 1 – Supplementary data

Number of Licensed HGVs

In 2020 there were around 35,000 HGVs registered in Scotland with approximately 2,800 new units added to the fleet (DfT Vehicle Licensing Statistics).

Source: DfT Statistics

There have been fluctuations in the number of newly registered HGVs. Following a consistent increase, there was a decrease in registrations following the 2008 financial crisis. There was another period of increased registrations (albeit with some fluctuations) to 2016, following which there has been a reduction year on year, with 2020 recording the lowest number of registrations since 2011.

Source: DfT Statistics

Average of Licensed HGVs

In Scotland at the end of 2019, the average age of vehicles taxed to carry goods (Time since first registration not manufacture date) was 6.5 years. This has increased from 5.8 years in 2000 (Scottish Transport Statistics no 40 - 2021 Edition Chapter 1 Vehicles ). However, data for the UK reveals that around 17% of HGVs are over 13 years old.

Source: DfT Statistics

Types of HGVs

HGVs encompass a wide variety of sizes with many different variants allowing a single base chassis to perform a multitude of tasks across different sectors. Many HGVs have auxiliary equipment fitted to enable them to perform specific tasks including refrigerated containers, pallet lifts, vehicle transporters etc.

The four main types of HGV segments in the UK are as follows:

- Small Rigid (3.5-7.5t): Used to predominantly deliver goods, such as parcels, to homes and businesses in cities

- Medium and Large Rigid (7.5-25t): Used for mid distance distribution of goods, such as food and clothes, between depots along motorways, and from depots to shops in city centres.

- Very Large Rigid (Over 25t): Used for moving goods, such as wood, metals, and materials, from production sites to construction and industrial sites

- Small & Large Articulated HGVs (Over 25t): HGVs made from two parts, a cab pulling a trailer. Predominantly used to deliver goods, such as food and materials, long distances on motorways. Goods imported / exported between Scotland and the UK/Europe are often moved via these vehicles

A summary of vehicle classes and associated journey types is shown in Table 2‑A. It is noted that the percentage figures presented in Table 2-A include Refuse Collection Vehicles (RCVs) which are excluded from the scope of the Taskforce. RCVs exist in the medium rigid, large rigid, and very large rigid vehicle segments, though we are unable to confirm what percentage of each segment is configured as an RCV.

| Vehicle Class | % of the fleet | Most Common Cargo (% of vehicle km) | Common Usage Location | Average Daily Mileage (km/day) | Maximum Daily Mileage (km/day) |

|---|---|---|---|---|---|

| Small Rigid (3.5-7.5t) |

22 | Mail (>30%) Machinery (>10%) Food (>10%) |

Urban | 200-250 | 400-500 |

| Medium Rigid (7.5-17t) |

7 | Food (>20%) Waste (>20%) Clothes (>10%) |

Urban & Motorway | 250-300 (except waste =100) | 500-600 |

| Large Rigid (17-25t) |

15 | Waste (>20%) Machinery (>10%) Food (>10%) Clothes (>10%) |

Urban & Motorway | 250-330 (except waste = 100) | 500-600 |

| Very Large Rigid (Over 25t) | 21 | Waste (>30%) Raw Materials (>10%) Materials & Minerals (>10%) Food (>10%) |

Urban for waste collection, Motorway & Industrial sites | 250-350 (except waste = 100) | 500-600 |

| Small Articulated (Less than 33t) | 5 | Mail (>40%) Food (>30%) Clothes (>10%) |

Urban, Motorway | 300-375 | 550-750 |

| Large Articulated (Over 33t) | 30 | Food (>30%) Materials & Minerals (>10%) Waste (>10%) |

Motorway | 350-450 | 600-800 |

Vehicle Movements

In 2020, 11.6 billion tonne-kilometres of freight originating in Scotland was transported to all destinations, of which 64% (7.9 billion tonne-km) remained within Scotland. This overall total was a 18% decrease compared to 2019 figures.

Source: Scottish Transport Statistics 40 2021

A description of the origin and destination of freight within the UK which either started or ended in Scotland is provided in Table A1. This data represents the average per year between 2016 and 2020.

| - | Journey Ended In | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Journey Started In | Shetland | Highlands and Islands | North-east | Tayside | South-east | Glasgow and west | South west | Scotland | Elsewhere in UK | Total |

| Shetland | 263 | * | * | * | * | * | * | 265 | * | 265 |

| Highlands and Islands | * | 10,798 | 531 | 191 | 175 | 457 | * | 12,184 | 1,805 | 13,989 |

| North-east | * | 650 | 8,767 | 232 | 317 | 298 | * | 10,294 | 1,398 | 11,692 |

| Tayside | * | 228 | 346 | 1,885 | 681 | 681 | 49 | 3,870 | 551 | 4,421 |

| south-east | * | 328 | 492 | 522 | 9,956 | 1,844 | 326 | 13,469 | 1,605 | 15,074 |

| Glasgow and west | * | 400 | 392 | 434 | 1,865 | 12,238 | 490 | 15,819 | 2,332 | 18,151 |

| South west | * | * | * | 226 | 181 | 381 | 1,798 | 2,644 | 1,339 | 3,983 |

| Scotland | 266 | 12,463 | 10,529 | 3,491 | 13,175 | 15,899 | 2,722 | 58,544 | 9,030 | 67,574 |

| Elsewhere in UK | * | 1,924 | 2,112 | 533 | 2,372 | 2,991 | 1,352 | 11,284 | 1,358,725 | 1,370,009 |

| Total | 266 | 14,387 | 12,641 | 4,023 | 15,547 | 18,890 | 4,073 | 69,828 | 1,367,755 | 1,437,583 |

In terms of goods lifted (tonnes):

- There were an estimated 93.3 million tonnes of goods lifted within Scotland by UK HGVs and transported to destinations within Scotland.

- Around 11.9 million tonnes of goods from Scotland were delivered to the rest of the UK.

- Around 15.6 million tonnes of goods entered Scotland on UK HGV from the rest of the UK, with 33% from the Northwest, 23% from Yorkshire and Humber and 19% from the Northeast.

- The amount of international road freight transported by UK HGVs to and from Scotland was less than 1 million tonnes, with 35% transported to France and 11% to the Netherlands.

- Around 24% of goods moved are in relation to the food sector, followed by 14% related to agricultural products (Figure A-4).

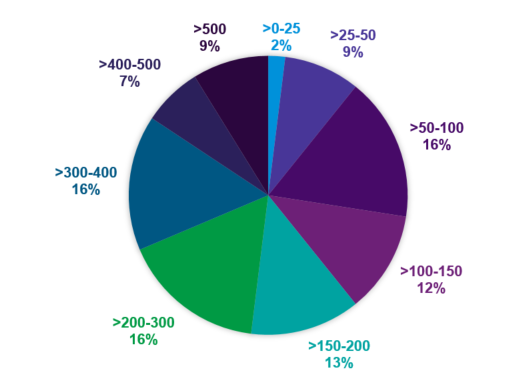

- Around 67% of road freight journeys are less than 100 kilometres. The average journey distance, derived by dividing the total tonne-kilometres by total tonnes lifted, was 108km.

- Around 28% of road million tonne-kilometres of goods are transported in trips less than 100 kilometres (Figure A-5).

- Data from 2016-2020 shows that goods transported by UK registered HGVs that stayed within Scotland tended to start and finish their journeys within the same region

Source: DfT Road Freight Statistics

Types of Goods Lifted

Figure A6 shows the split of goods moved by sector by million tonne-kilometres, with around 20,000 million tonne-kilometres of goods remaining in Scotland or entering / leaving Scotland for the rest of the UK. Food products, including beverages and tobacco, were the most common type of freight lifted and remaining in Scotland in 2019, at approximately 17.7 million tonnes. As shown, a quarter of goods moved are in relation to the food sector, followed by 13% related to agricultural products.

Source: Transport Scotland Statistics

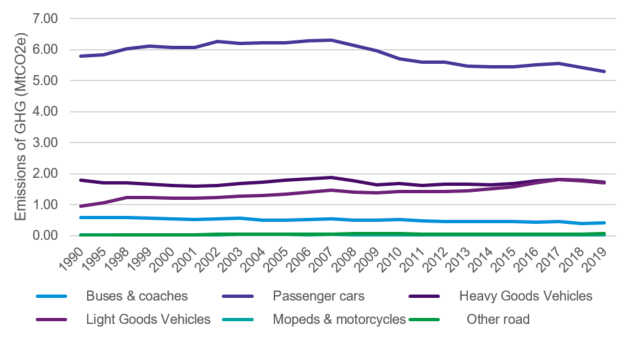

GHG Emissions

In 2019, transport accounted for 36% of Scotland’s Greenhouse Gases (GHG) (13.95MtCO2e), of which road transport made up 66% (9.23 MtCO2e). HGVs were a significant contributor, accounting for 12.3% of emissions in 2019 (1.72 MtCO2e), with emissions fluctuating from 2010-2019 and at their lowest in 2011 (1.63 MtCO2e) (Transport Scotland Statistics 40: Chapter 13: Environment and Emissions).

Source: Scottish Transport Statistics

In the period between 1990-2018, HGV GHG emissions in Scotland increased by 4% compared to 1% in the UK. However, emissions decreased 1% between 2017 and 2018, whilst HGV vehicle kilometres increased by 0.1% (two million vehicle kilometres) (Carbon Account for Transport No.12: 2020 Edition). The GHG emissions per segment size have also been estimated, with 2.06 MtCO2e emitted in total, as shown in the figure below (Calculated using a combination of data sources referenced throughout this paper and UK Government 2021 GHG Conversion Factors).

Source: Mott MacDonald Calculations using Element Energy, DfT Statistics and Defra data sources

Summary of Findings from Research

- Over a third of HGVs are articulated vehicles (ie carrying heavy loads and made up of from two parts) travelling the long distances

- A quarter of HGVs registered in Scotland are small rigid and travel between 200-250km a day, with mail the most common type of goods moved

- Food is the most moved good to, from and within Scotland. It is transported by HGVs of all sizes, however over 30% is transported by small articulated vehicles with an average daily mileage of 300-375km. The Scottish wholesale sector was worth £2.9bn prior to Covid, and over half its members regularly service all areas of Scotland, mainly using motorways and A-roads.

- Over a third of HGVs registered in Scotland are either Large Rigid or Very Large Rigid. Waste makes up a large proportion of the goods transported by these HGVs (over 20% of cargo vehicle kilometres in large rigid and over 30% in very large rigids), albeit they have a lower average daily mileage of 100km compared to the moving of other goods