Approach to benchmarking

Introduction

The purpose of the international benchmarking exercise is to develop an understanding of the different models adopted by ferry operators internationally and what these models help to deliver. The information gathered as part of this exercise enabled the identification of key points of difference and highlight what may be desirable in Scotland.

This section includes an overview of the following:

- International benchmarking of lifeline ferry services

- Domestic benchmarking of public services that share similarities with the ferry sector

More detailed commentary on both is included as an appendix (see PDF version).

International Benchmarking Approach

The global ferry industry is similar in size to the commercial airline industry, transporting approximately 2.1 billion passengers each year, 250m vehicles and 32m trailers (excl. China). Operators can be publicly and privately owned, serve urban and rural communities, and function under a wide variety of structures and operating models.

We reviewed a number of ferry operations from around the world and have included in this chapter a review of four comparators. These are as follows:

- Canada (British Columbia)

- Norway

- New Zealand (Auckland)

- Australia (NSW)

These case studies were selected after being recommended as suitable options during initial discussions with the Tripartite. Their suitability is based on the presence of subsidy and, in the case of Canada, Norway and to a lesser extent New Zealand, provision of lifeline ferry services. The availability of suitable material on which to base our research was also a relevant factor.

The benchmarking exercise was informed by interviews with industry and government figures, as well as reviews of relevant documentation, including government policy papers, company annual reports and academic papers.

The table below summarises the key statistics of the ferry services that have been considered as part of the international benchmarking exercise.

| Benchmark | Scotland | Canada | Norway | Australia | New Zealand |

|---|---|---|---|---|---|

| Awarding Body | Transport Scotland | Province of British Columbia | Norwegian Public Roads Administration / local authorities | Transport for NSW | Auckland Transport |

| Regulator | No | Yes | No | No | No |

| Contract Holder | CFL | BC Ferries | Multiple | Transdev | Multiple |

| Operator Ownership | Public | Public | Private | Private | Private |

| Vessel Owner | Public | Public | Private | Public | Private |

| Infrastructure Owner | Public | Public | Public | Public | Public |

| No. of Passengers | 5m p.a. | 22m p.a. | 44m p.a. | 15m p.a. | 6m p.a. |

| Farebox | £76m | £360m | [Redacted] | £21m | [Unknown] |

| Subsidy | £149m | £145m | [Redacted] | £58m1 | [Unknown] |

| Profit Before Taxation | £1m | £17m | [Unknown] | [Unknown] | [Unknown] |

| No. of Vessels | 31 | 35 | 203 | 32 | 30 |

| Avg. Age of Vessels | 22 years | 33 years | 26 years | 24 years | [Unknown] |

| No. of terminals | 52 | 47 | [Unknown] | 38 | 21 |

| No. of Routes | 29 | 25 | 120 | 9 | 24 |

| Contract Length | 8 years | 60 years | 6-10 years | 9 years | 6-12 years |

| Contract Type | Farebox risk with operator | Farebox risk with operator | Multiple2 | Operate and Maintain | Farebox risk retained by authority |

Canada – BC Ferries

- BC Ferries carries in the region of 22m passengers per annum across 25 routes. It owns the majority of its 35 vessels, which have an average age of 33 years.

- It serves tourists and commuters, as well as providing lifeline and long-distance ferry services.

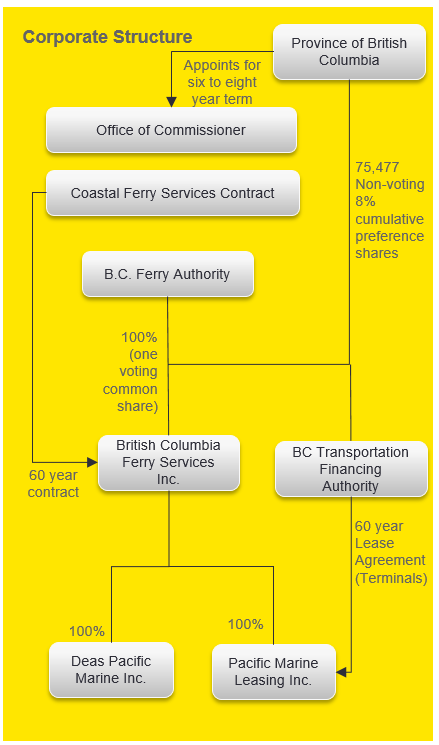

- The Province owns 75,477 non-voting 8% cumulative preferred shares in BC Ferries and receives an annual dividends payment. These shares do not provide the Province with a voting interest in BC Ferries.

- BC Ferries entered into the Coastal Ferry Services Contract with the Province of British Columbia on 1 April 2003 for a 60 year term.

- As the operator it holds farebox risk under the contract, which can be amended on a four year rolling basis following a price cap review by the commissioner.

- BC Ferries owns and operates its own vessels which it pays for via private sector finance. The Province owns the land and structures comprising most of the terminals operated by the company. This infrastructure is leased to BC Ferries for the 60 year term commencing 1 April 2003.

- BC Ferries operations are regulated by a commissioner whose responsibilities include establishing price caps, monitoring adherence to the contract and authorising major spend.

Observations for Future Options

The presence of a commissioner and the long length of BC Ferries’ contract provides it with significant independence. BC Ferries employs this independence to adopt a highly commercial approach to its operations; previously this has been manifest in its executive pay (noted for being high) and vessel construction (noted for being undertaken overseas).

The independence BC Ferries has been endowed with required the Government of British Columbia to surrender a significant degree of control. However, in our engagement with stakeholders it was noted that from the perspective of the public, the Government remains responsible and perceived failings by BC Ferries continue to be associated with the Government of the day.

The Provincial Government has attempted to redress this imbalance in recent years by amending the existing legislation to reduce BC Ferries’ commercial focus and encourage consideration of a wider range of socio-economic factors, including domestic shipbuilding.

The Government’s limited control means BC Ferries’ private debt does not sit on the Government’s balance sheet.

The Province of British Columbia owns 74,477 non-voting 8% cumulative preferred shares in BC Ferries. It also owns the BC Transportation Financing Authority, which owns a majority of the terminals used by BC Ferries. Voting ownership of BC Ferries is held by the BC Ferry Authority. BC Ferries owns 100% of Deas Pacific Marine Inc. and Pacific Marine Inc. The Province awards BC Ferries its 60 year operating contract (the “Coastal Ferry Services Contract”) and appoints the Commissioner for a 6–8 year term.

Norway

- Norway has a ferry fleet of c.200 vessels that deliver services across 120 ferry routes and carry 44m passengers each year.

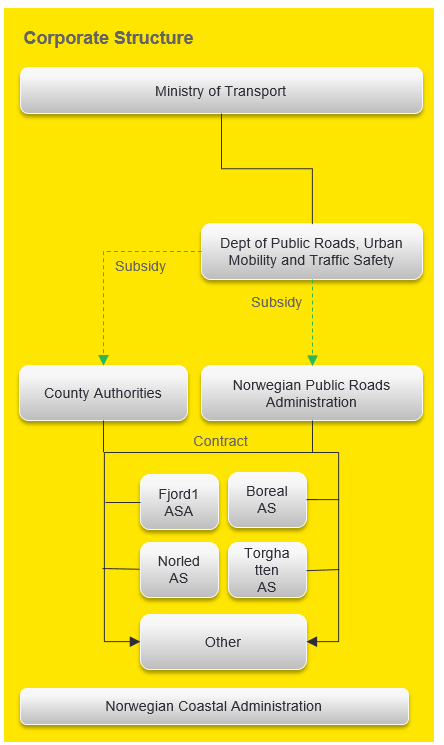

- Ferry services are procured through a number of separate contracts by either the national Norwegian Public Roads Administration or by individual county municipalities’ road authorities, according to whether or not the ferry service forms part of a national route.

- Of the country’s 120 ferry services, 16 are currently national routes and 114 are county routes.

- The normal contract length is 6-10 years although there is often an option to extend.

- Contracts are tendered on either a gross or net basis. In recent years there has been a tendency towards gross contracts.

- Government subsidy accounts for [Redacted] of the ferry sector’s income, which with farebox revenue amounts to [Redacted] per annum.

- Four private sector operators dominate the Norwegian ferries sector.

- In recent years operators have been required to procure low carbon vessels as conditions of their contracts, which has reduced the fleet’s average age to 26 years.

Observations for Future Options

Delivery is comparatively decentralised, with a majority of contracts being awarded and managed by local authorities.

The localised nature of ferry services procurement in Norway requires the network to be tendered in small bundles. This results in a larger volume of frequently tendered contracts which helps make the market attractive to operators who are better able to manage their asset risk because vessels can more readily be redeployed elsewhere in the market if a contract is lost. A transition to gross contracts has also increased the attractiveness of the Norwegian ferries sector to the private sector.

These characteristics have contributed to a competitive market dynamic in which market participants, incentivised by the threat of competition, are more responsive to Government demands. The procuring authorities have leveraged this influence by behaving as an ‘active procurer’ to steer the sector. This approach is complemented at a national level by clear strategic direction in relation to Government priorities such as green vessel replacement.

Central Government has also facilitated the decentralisation of ferry services procurement by investing in the skill set of local authority staff, for example by subsidising training for procuring ‘green’ ferry services.

County Authorities and the Norwegian Public Roads Administration are responsible for managing the operations of ferries. These bodies receive subsidy from the Department of Public Roads, Urban Mobility and Traffic Safety, which is part of the Ministry of Transport. The County Authorities and the Norwegian Public Roads Administration award contracts to private operators such as Fjord ASA, Boreal AS, Norled AS and Torghatten AS, typically for 6-10 year terms.

Australia – Transport for New South Wales

- The Sydney Ferries Network carries c.15m passengers per year and serves 36 ferry stops across nine routes. The customer base is predominantly tourists and commuters.

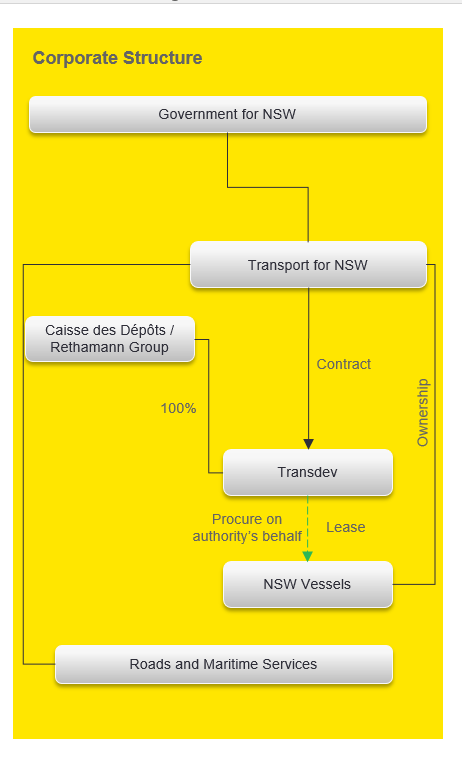

- Ferry services are provided under the Ferry System Contract, which is managed by Transport for New South Wales (TfNSW).

- The current operator is Transdev, which is owned by Caisse des Dépôts, an investment arm of the French Government, and the Rethamann Group, a German utilities, logistics and services group.

- TfNSW retains revenue risk and control over the fare structure, routes and timetables.

- The Government of NSW has a fleet of 32 vessels, which have an average age of 24 years. The Government also owns the wharf infrastructure.

- During the lifetime of the contract the operator leases the vessels from TfNSW and is responsible for both operational and long-term maintenance. TfNSW also owns a shipyard for maintenance and a berthing facility. Responsibility for maintaining the shipyard and berthing facility is passed to the operator for the duration of the contract.

- The annual subsidy awarded to Transdev is in the region of £58m per annum. The most recently available financial information

Observations for Options Analysis

A 2016 report by the Audit Office of NSW found that contracting with the private sector has enabled cost risk to be transferred away from the public sector. It also found that elements of service risk had been transferred; however, it recognised that there is a practical limit to such risk transfer as the Government ultimately remains responsible for the delivery of public transport services.

For the duration of the contract the operator is responsible for operational and long-term maintenance of the Government’s fleet of vessels. It is also responsible for the Government’s shipyard. This relationship has been extended under the 2019-28 contract and Transdev is now also responsible for procuring new ferries on behalf of Transport for NSW.

Transport for NSW, an agency of the Government of NSW, awards a contract to the private operator, currently Transdev (which is a subsidiary of Caisse des Dépôts / Rethamann Group). The vessels are owned by Transport for NSW and leased to the operator who operate and maintain the vessels during the period of the contract.

New Zealand – Auckland Transport

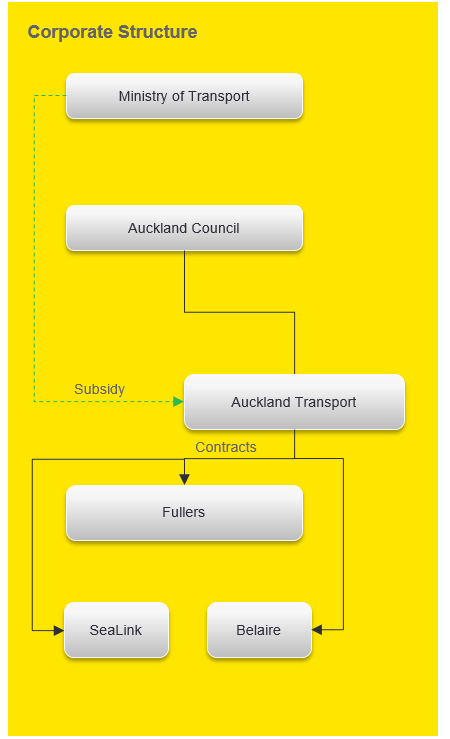

- The Auckland Ferries Network consists of 30 vessels and serves 24 routes from 21 terminals.

- It carried 6.3m passengers in 2019. Ferry services predominantly serve commuters and tourists, although services to Waiheke Island are considered lifeline.

- Private sector operators provide ferry services to Auckland Transport (AT) under contracts that have durations of between 6 and 12 years. Under this arrangement AT retains farebox risk while the operators, as the vessel owners, bear the asset risk.

- Operators supply their own vessels. Fullers, the dominant operator in the market, owns 21 vessels. AT manages 21 ferry facilities on behalf of Auckland Council, the infrastructure owner.

Observations for Options Analysis

AT’s regulatory framework leaves key ferry routes outside of Government control. This places clear constraints on AT’s sphere of influence and demonstrates the importance of an appropriately designed regulatory / legislative framework.

A procurement exercise in 2019 for ferry services was reported in the media to have failed due to AT’s demand that operators invest in new vessels. Operators attributed their resistance to short contract lengths.

As well as longer contract lengths, more market participants could help to create a more responsive market. As a means of removing barriers to entry AT has considered moving to a model whereby it supplies its own vessels, as in NSW.

Auckland Transport is a council-controlled organisation of Auckland Council. Auckland Transport awards contracts to various operators, including Fullers, SeaLink and Belaire. Auckland Transport receives subsidy from the Ministry of Transport, which it pays to the operators for delivering ferry services.

International benchmarking analysis

The table below summarise the key observations from the international benchmarking exercise.

| Key Points of Difference | CHFS | Canada | Norway | Australia | New Zealand |

|---|---|---|---|---|---|

| Commissioner | N | Y | N | N | N |

| Private Financing | N | Y | Y | N/A | Y |

| Integrated Roads and Ferries | N | N | Y | N | N |

| Decentralisation | N | N | Y | N | N |

| Competition | Y | N | Y | N | N |

| Operator Owned Vessels | N | Y | Y | N | Y |

| Operator Managed Shipyard | N | N | Unknown | Y | Unknown |

| Revenue Demand Risk | Y | Y | Y/N | N | N |

| Asset Risk | N | Y | Y | N | Y |

Governance and Commercial Structures

Governments wield varying levels of strategic and operational control over their respective ferry sectors and operators. To the extent that control exists, governments exercise this via a number of levers, including:

- Contractual relationships

- Clear policy direction

- Exploiting competitive market dynamics

There is no uniform approach to risk transfer among the comparators. However, a minimum level of reputational and service level risk is always retained by the procuring authority. This is particularly true in the context of lifeline ferry services where the Government serves as the Operator of Last Resort (as per the Scottish model).

This practical limit on the transfer of reputational risk was recognised in discussions with the Government of British Columbia who found they were still held responsible for certain elements of service delivery despite control being largely transferred to BC Ferries.

This was also recognised in the Audit Office of NSW’s report into ferry franchising, which found there is a “practical limit” to the transfer of service risk

Domestic Sector Analysis – Approach

As well as exploring international comparators, we have reviewed domestic sectors that share similarities with Scotland’s ferries sector in order to understand their governance and regulatory frameworks and to identify any models that should be included within the long-list of structural options for the future CHFS network. We reviewed a number of sectors and have performed a comparison of four that we consider relevant to the ferry sector in Scotland. These are as follows:

- Scotland’s road network

- Scotland’s rail network (and proposed UK reforms)

- HIAL

- Scottish Water

This exercise was informed by reviews of relevant documentation, including government policy papers, company annual reports and academic papers, and select interviews with individuals from these industries.

Scotland’s Road Network

- The roads network in Scotland is made up of six categories of roads: motorways and trunk roads, A roads, B roads, C roads, Unclassified roads and Private roads

- Responsibility for maintaining the roads is shared between TS and local authorities in Scotland: management of the roads network in Scotland is partially decentralised, with non-trunk roads being the preserve of local authorities and trunk roads being overseen by TS.

- This devolved responsibility for roads maintenance results in variable service quality: an Audit Scotland report on roads maintenance found that 87% of those surveyed felt trunk roads were in an acceptable conditions, compared to 67% for council roads.

- Variable levels of spend between local authorities has also been noted. A similar trend was recorded in the review of Norway’s ferry network, whereby a decentralised model in which local authorities are responsible for minor routes has contributed to inconsistent service delivery across the network.

- An independent commissioner has been put in place with an aim to improve the quality of Scotland’s roads, although maintenance performance has continued to fall.

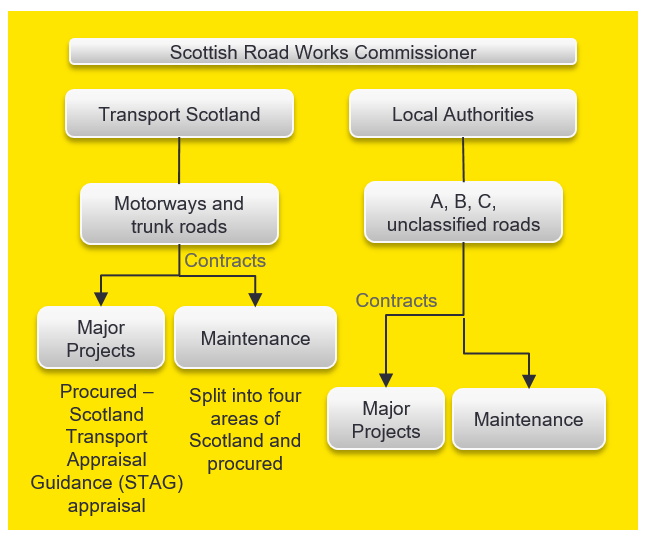

Scotland’s road network is managed jointly by Transport Scotland (motorways and trunk roads) and Local Authorities (A, B, C, and unclassified roads). Both authorities award contracts for the construction of major projects and for maintenance of these roads. An independent Scottish Road Works Commissioner monitors the performance and quality of roads in Scotland.

Scotland’s Rail Network

- Scottish Ministers have powers to set a strategy for railways, specify outputs which help support the delivery of that strategy and provide funding. They are able to specify rail passenger services in Scotland and do so through the ScotRail and Caledonian Sleeper franchises. The Department for Transport (DfT) is responsible for those functions transport in England and Wales, including reserved areas of safety and accessibility.

- The current ScotRail franchise contract is in place with Abellio ScotRail and is scheduled to end on 31 March 2022 following the decision not to extend the contract. ScotRail services will be operated through a wholly-owned company after the end of the current franchise in line with our Operator of Last Resort duty.

- Network Rail owns most of the UK’s rail infrastructure (tracks, signals, bridges, tunnels and stations), and receives funding from the Scottish Government to maintain and improve Scotland’s rail infrastructure. ScotRail leases the stations it manages from Network Rail and is responsible for leasing its trains from rolling stock companies (ROSCOs), and the terms of the leases include specific provisions as to who is responsible for various elements of maintenance (wet lease / dry lease). ScotRail secures the use of the network through a track access agreement with Network Rail.

- The Office of Rail and Road (ORR) is the independent rail safety and economic regulator for the railways in the UK. It sets delivery targets for Network Rail and determines its funding based on a regulatory assessment of how much the outputs should cost if delivered efficiently.

- Separating ownership of rolling stock from the operator reduces the latter’s asset risk in order to favourably impact the cost of contract delivery, and also facilitates competition as successor operators have ready access to suitable rolling stock. The fragmented nature of the rail industry has however caused challenges, which the UK Government’s Williams-Shapps Plan for Rail seeks to address via greater integration.

UK Rail Reform

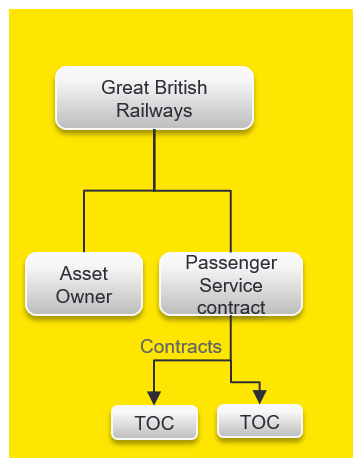

The UK Government launched a review (the Williams Review) of the structure of the rail industry and the way in which rail passenger services are delivered across the UK in 2019. In May 2021, the Secretary of State for Transport announced a number of reforms to the UK rail industry, including the creation of a new public body, Great British Railways (GBR), to plan and run the railway, bring together the infrastructure and services, and receive fare revenue across the UK.

There is a presumption of the use of the private sector for the operational delivery of rail services under Passenger Service Contracts which will be competitively procured. While there is acknowledgment of the existing devolved arrangements, and a commitment to “explore options with Transport Scotland to enable the railway in Scotland to benefit from the reforms on the wider network of GB”. There is no further detail on what this means or how it is intended the structure of GBR will operate in a devolved environment and therefore it remains unclear how this will work in Scotland.

Great British Railways will own the railway assets and infrastructure (tracks, signals, bridges, tunnels, and stations). It will award passenger service contracts to Train Operating Companies.

Scottish Water / Highland and Islands Airport Limited

Scottish Water

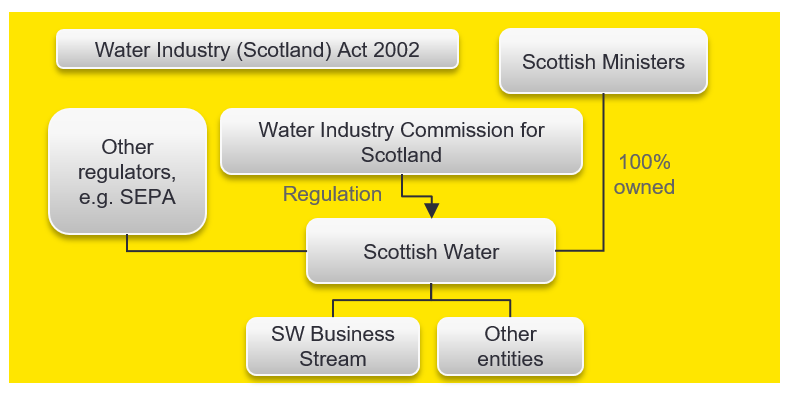

- Scottish Water was founded in 2002 following a merger of three water authorities. The purpose of the merger was to make the Scottish water industry more efficient and competitive, improve VfM and harmonise charges across Scotland.

- Scottish Water is a monopoly business (except in the retail market) and supplies water to households under the relevant legislation and in line with a broad strategic framework set by the Scottish Ministers.

- Scottish Water is funded through revenue raised from customer charges and borrowing from the SG via the Scottish Consolidated Fund.

- Water Industry Commission for Scotland (WICS) is a non-departmental public body with statutory responsibilities. It is the economic regulator for the Scottish water industry and acts independently of Ministers. It is staffed by a team of c.20 people. Members of the Commission are appointed by the Scottish Ministers for a period of four years.

Scottish Water is wholly owned by Scottish Government and supplies water to households in Scotland under the Water Industry (Scotland) Act 2002. The body is regulated by the Water Industry Commission for Scotland. Scottish Water’s retail business, which supplies water to non-household customers, is managed through its commercial arm, Business Stream.

Scottish Water – Observations for Options Analysis

- Each six year regulatory period provides an opportunity for the WICS to independently assess Scottish Water’s funding requirements and to set price caps in line with this. This helps to ensure adequate funding for the sector.

- The SG’s input to the Strategic Review of Charges provides an opportunity for it to appraise and renew the policy framework that underpins Scottish Water’s operation. This helps to ensure the Government assumes an active role in setting the strategic direction of the sector.

- Scottish Water maintains a commercial arm via Scottish Water Business Stream. These activities are siloed within a separate legal entity.

Highlands and Islands Airports Limited

- HIAL is wholly owned by Scottish Ministers, therefore its vision and goals can be readily aligned with those of Scottish Ministers.

- A framework document between HIAL and the SG sets out the broad context within which HIAL operates and defines key roles and responsibilities which underpin the relationship between HIAL and TS.

- HIAL receives an operating subsidy from the SG for the continuation of operations at its 11 airports. This subsidy amounts to half of all revenue received. HIAL also receives funding in the form of capital grants from the SG for investments and upgrades to the airports it operates

HIAL – Observations for Options Analysis

- As has been noted as part of the international benchmarking, retaining the capacity to influence the operator of lifeline services is important as a degree of reputational risk and service delivery risk is always retained by the Government.

- The Framework Agreement in place between HIAL and SG provides a clear foundation for the working relationship between the two parties and could serve as a blueprint for a similar framework for the Tripartite.

Sector Analysis: Key Commercial Considerations

The table below summarises the key observations from the sector analysis exercise.

| Key Points of Difference | Roads | Rail | Water | HIAL |

|---|---|---|---|---|

| Commissioner | Y | Y | Y | Y |

| Integration | Y/N1 | Y | N | N |

| Privatisation | N | Y | N | N |

| Decentralisation | Y | N | N | N |

| Competition | Y | Y | N | N |

| Revenue Demand Risk | N | Y | N | Y |

| Asset Ownership | Y | Y/N2 | Y | Y |

1 Trunk roads are integrated by minor roads owned decentralised to local authorities.

2 NR own track infrastructure and stations, ROSCO’s own trains.

Governance and Commercial Structures

The sector analysis identified four key themes around the commercial structures in place:

Regulation

Independent regulation features in all of the sector case studies. The scope of these regulators’ powers varies considerably, with the Scottish Road Works Commissioner (SRWC) (roads) representing a comparatively light touch version of regulation compared to the economic regulation provided by the latter three bodies. In all instances the regulatory function provides an independent perspective on the performance of their respective sectors, something the ferries sector in Scotland does not currently benefit from. Regulatory powers could also extend to setting price caps to facilitate investment while also protecting consumer interests in monopolistic environments. The precise remit of any potential regulator should reflect the specific challenges faced by Scotland’s ferries sector.

Integration

There are differences in the way in which the ownership of assets are structured across the four sectors. Trunk roads (but not minor roads) are fully integrated within TS, which provides the latter with a great deal of control over how this service is delivered to the public. In rail, there has been more fragmentation, with the core infrastructure owned by NR and Government awarding franchises to private operators who are then responsible for service delivery. The absence of integration was a key observation in the recent Williams-Shapps Plan of the rail sector and remedying this via the establishment of GBR is one of the report’s headline recommendations.

Privatisation

Private sector involvement is present in all four models to varying extents. In rail and aviation, operators are typically private. Privately owned ROSCOs lease rolling stock to TOCs. The core infrastructure in rail is state owned via NR (soon to be GBR) but in the aviation sector tends to be privately owned. There are, however, notable exceptions to the above: the SG will in 2022 assume responsibility for Abellio ScotRail’s operations as the Operator of Last Resort. Similarly, the SG is the owner of HIAL. The requirement for the SG to ‘step-in’ reflects Abellio and HIAL’s status as providers of critical or lifeline services. The SG would also need to be prepared to step in as the Operator of Last Resort for ferry services under a scenario where service delivery is privatised and the operator encounters difficulties. Scottish Water has remained in public hands while the water sector in England & Wales has been privatised. This has afforded Scottish Ministers greater control over the sector and has also supported lower borrowing costs, which has resulted in lower water charges for consumers.

Decentralisation

Decentralisation is present in Scotland’s roads sector, with responsibility for non-trunk roads sitting with local authorities. Service delivery in the other sectors that were considered in this section were managed centrally.

< Previous | Contents | Next >