Executive summary

Introduction to Project Neptune

This report includes benchmarking of international ferry operations and other subsidised sectors in the UK and the preliminary evaluation of a long-list of strategic options that in future could be implemented to improve delivery on the CHFS network.

Introduction

Transport Scotland (TS) seeks to deliver a safe, efficient, cost-effective and sustainable transport system for the benefit of the people of Scotland, thereby playing a key role in realising Scottish Government’s (SG) purpose of achieving sustainable economic growth with opportunities for all of Scotland to flourish. Ferry services in Scotland fulfil a critical function within the wider transport system, providing lifeline services to island communities.

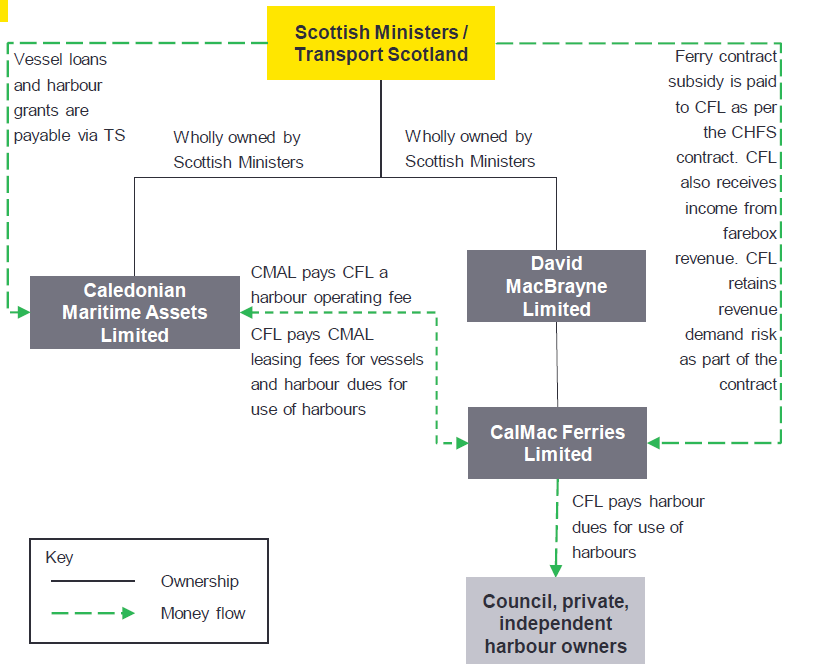

The services on the Clyde and Hebrides Ferry Service (CHFS) network are subsidised by Scottish Ministers and delivered by three parties: TS, Caledonian Maritime Assets Limited (CMAL), and CalMac Ferries Limited (CFL) as a wholly owned subsidiary of David MacBrayne Limited (DML) (together “the Tripartite”).

Purpose and approach

The delivery and cost of ferry services and the relationships between the Tripartite are complex and Scottish Ministers are mindful of the perception that exists of a lack of accountability among the parties.

The objective of this review is to provide Ministers with a strategic framework of options for the CHFS network.

- On behalf of Scottish Ministers our review’s purpose is to help to identify the preferred corporate and governance structures for the delivery of ferry services under a range of potential future scenarios.

- This strategic framework of options provides Ministers with our views on what could be done to the CHFS network, rather than on what should be done.

- Any structure proposed for delivering ferry services on behalf of Scottish Ministers should enhance passenger experience, support local communities and be accountable, transparent and capable of achieving Best Value.

In order to inform the options we have undertaken an international benchmarking exercise of lifeline ferry services and a review of comparable subsidised industries in Scotland. The options considered draw on findings from each of these exercises and have been evaluated using an agreed set of criteria.

The CHFS network is primarily delivered by three parties: TS, which acts on behalf of Scottish Ministers and is responsible for setting policy and procuring lifeline services; CMAL, which is the asset owner of 36 vessels and 26 harbours (used across both the CHFS and the Northern Isles Ferry Services (NIFS) networks) and; and CFL, which is the operator and is responsible for the delivery of services under the CHFS2 contract.

Benchmarking

The benchmarking exercise did not reveal a predominant model for delivering ferry services. Key points of difference include the presence of a regulator; the role of the private sector; the extent of competition in the market; the scale of risk transfer; and the approach to asset ownership.

International Benchmarking

The purpose of the international benchmarking exercise was to provide an understanding of the different models adopted by ferry operators in overseas markets. We reviewed a number of ferry operations from around the world and undertook an in-depth review of four comparators: Canada (British Columbia), Norway, New Zealand (Auckland) and Australia (New South Wales or NSW).

Strategic and Operational Control

Governments wield varying levels of strategic and operational control. To the extent that control exists, Governments exercise this via a number of levers including contractual relationships, regulation, clear policy direction and/or exploiting competitive market dynamics.

Risk Transfer and Accountability

There is no uniform approach to risk transfer among the comparators. However, a minimum level of reputational and service level risk is always retained by the procuring authority.

| Criteria | Scotland | Canada | Norway | Australia | NZ |

|---|---|---|---|---|---|

| Regulator | No | Yes | No | No | No |

| Operator ownership | Public | Public | Private | Private | Private |

| Vessel owner | Public | Public | Private | Public | Private |

| Infrastructure owner | Public | Public | Public | Public | Public |

| No. passengers | 5m p.a. | 22m p.a. | 44m p.a. | 15m p.a. | 6m p.a. |

| Subsidy (per year) | £149m | £145m | [Redacted] | £58m (1) | Unknown |

| No. vessels | 31 | 35 | 203 | 32 | 30 |

| Avg. age of vessels | 22 years | 33 years | 26 years | 24 years | Unknown |

| No. routes | 29 | 25 | 120 | 9 | 24 |

1 - Government funding represents the net contract payments to the private operator.

Domestic Benchmarking

As well as exploring international comparators, we have considered UK sectors that share similarities with the ferries sector in order to highlight their governance and regulatory frameworks and to identify models that could be included within the long-list of structural options for the future CHFS network.

This exercise focused on a number of Scotland’s key infrastructure sectors which provide services under contract with Government. These comparators were considered most relevant to the ferry sector.

The following domestic sectors were reviewed:

- Scotland’s road network

- Scotland’s rail network and the proposed UK rail industry reforms

- Highlands and Islands Airports Limited (HIAL)

- Scottish Water

Regulation

In the domestic sphere, the presence of a regulator featured in all of the case studies considered. Regulators’ responsibilities varied considerably from ‘light touch’ (roads sector) to more heavily regulated sectors, including a Regulated Asset Base model in which private investors receive a regulated return that is set by an economic regulator. In all instances the function provided an independent perspective on performance.

Delivery model

The degree of control across sectors varied. The roads network is segregated, with TS owning and maintaining trunk roads, whereas responsibility for non-trunk roads sits with local authorities. This differs in the rail sector where Network Rail (NR) (GBR under the new model) is responsible for the infrastructure and Train Operating Companies (TOCs) operate train services.

Private sector involvement

Private sector involvement is present in all four models to varying extents. In rail and aviation the operators are typically private. However, there are examples (such as rail) where Government has on occasion stepped in as an Operator of Last Resort (OLR).

Future Options

When reviewing future options for the CHFS network we have considered the following:

- commercial contractual considerations;

- options relating to increased regulation; and

- options relating to structural reform.

The diverse types of control and risk transfer observed in the benchmarking exercise reflect the absence of a predominant framework for delivering subsided services.

The key points of difference between the case studies nonetheless provide a useful illustration of the characteristics that could feature in a future model for Scotland’s ferry sector. These include:

- The presence of an independent regulator or commissioner

- The ability of the operator to independently raise finance

- The extent to which procurement and management of ferry services should be decentralised

- The merits of an integrated approach in which roads and ferry services are managed together

- The presence of competition and the means by which it can be stimulated

- The full range of options for owning and maintaining key assets

- The distribution of revenue demand and asset risk

These themes have been used to inform the development of the long-list of options that have been appraised in this report.

When reviewing the future options for ferry services, we have sought to include:

- Commercial contractual considerations

- Options relating to increased regulation

- Options for structural reform

The text below includes an overview of our considerations which will be outlined and evaluated throughout the remainder of this report.

Future Considerations

Commercial contractual considerations

- Direct Award

- Long-Term Contract

- Management Contract

Options for Increased Regulation

- Commissioner or Regulator

- Regulated Asset Base

Options for Structural Reform

- Integration/ Assimilation

- Privatisation

- Decentralisation

Commercial Considerations

Prior to any decision on the future of CHFS, Ministers should consider their longer-term aspirations. Commercial changes, such as a Direct Award or a change to the contract length, should complement any regulatory or structural change.

The current CHFS contract expires in 2024. Contracts of this nature typically take in the region of 18 months to 24 months to procure (excluding the preparatory phase). Prior to embarking on any procurement exercise, TS should internally agree the contract’s key commercial principles, ideally by summer 2022, in order to allow adequate time for the subsequent procurement exercise. TS should also identify its longer-term strategic objectives for the ferry service so that the contract procured complements any structural change that is undertaken in pursuit of these.

We have identified ways in which Ministers could amend the contractual relationship with the operator as part of the next CHFS procurement. These commercial considerations are distinct from the governance and structural changes that are the primary focus of our work, but could be considered in conjunction with any further changes made to the structure of the Tripartite.

Risk Allocation

- Under a Management Contract, the transfer of risk to the operator is less extensive. A Management Contract of this nature could be preferable if it is judged that the operator has limited means of influencing farebox revenue or controlling certain types of spend (i.e. maintenance of vessels). The operator is paid a fixed fee for delivering the services.

- This could potentially make the CHFS contract more efficient for SG and more attractive to operators. This may be desirable if TS wishes to stimulate competition in the market.

- However, a potential downside of using a Management Contract is that without exposure to revenue risk or full cost risk, the operator may be less incentivised to drive performance without an appropriate KPI regime.

Contract Length

- The CHFS3 contract could be let with a longer contract length. This could facilitate longer-term strategic thinking amongst the Tripartite.

- The merits of longer contract lengths have been recognised in British Columbia, where British Columbia Ferries (BC Ferries) holds a 60 year contract. To support investment in low carbon vessels, procuring authorities in Norway have also extended some contracts to 15 years

- A potential risk presented by longer contract lengths is, however, that in the absence of regular procurements, operators become complacent and service delivery declines. As with management contracts, an appropriate KPI regime would be required to incentivise / disincentivise certain behaviours.

Direct Award

- TS could make a Direct Award to CFL for the CHFS contract rather than running a competitive procurement. In doing so, TS would need to satisfy the legal considerations from both a procurement and a UK Subsidy Control perspective.

- Direct Awards are permissible in short-term situations while a longer-term solution is sought. However, it must be demonstrated that the Direct Award represents VfM. It is under these circumstances that a number of Direct Awards have been issued during the pandemic.

- The negotiation process under a Direct Award does not benefit from the competitive tension present in a normal procurement, which may result in less competitive terms.

Prior to any changes to the corporate and governance structures that deliver ferry services in Scotland, Ministers should consider their longer-term objectives for the sector, and whether it can best achieve these objectives through commercial or structural means, or a combination of both.

Future Options

We have developed a list of options under four themes: regulation, integration, privatisation and decentralisation. We undertook a preliminary evaluation of the options to assess whether an option had the potential to achieve or contribute towards Best Value.

Enhanced Regulation and Structural Reform

When carrying out our review of international comparators and subsidised services we identified a number of themes that captured the key variations between the case studies. As well as different commercial considerations (see previous slide), benchmarking highlighted the different approaches to regulation and delivery models.

We have presented below a long-list of options that includes both enhanced regulation and structural reform. The individual themes identified are not exclusive of one another and combinations of options could conceivably feature in a future model for Scotland’s ferries sector. They could also be implemented in conjunction with a number of the commercial considerations already highlighted. However, for the purposes of this appraisal, we have looked at each option independently.

Enhanced Regulation

Independent regulation features in all of the sector case studies considered in this report. The scope of these regulators’ powers varies considerably: at a minimum the regulator or commissioner provides an independent perspective on the sector; under more expansive regulatory regimes their powers can extend to a Regulated Asset Base model (treated as a distinct option in this report).

Regulation

- Commissioner / Regulator

- Regulated Asset Base

Structural Reform

For each option we have included an overview of the corporate structure, roles and responsibilities and examples of how this would work in practice.

Integration / Assimilation

- Assimilation of TS and CMAL

- Integration of CMAL and DML

- Integration of CMAL and CFL

Privatisation

- CMAL assets sold to the private sector

- CFL sold and any future contract is let to the private sector.

- Disinvestment of non-core operations

Decentralisation

- Local authorities procure and manage ferry services

- Local authorities procure and manage ferry services and assets

- TS manages major routes. Local authorities manage smaller routes

The long-list of structural options has been evaluated using criteria drafted with reference to TS’ mission of delivering a “safe, efficient, cost-effective and sustainable transport system”. These criteria have been developed to understand whether the option has the potential to achieve Best Value. They include:

- Passenger Experience and Local Communities

- Deliverability

- Accountability & Transparency

A qualitative assessment has been performed as to whether the impact of an option would be positive, neutral or negative on each criterion.

Preliminary Evaluation

The preliminary evaluation exercise found merit in greater regulation and integration, but noted substantial challenges in relation to privatisation. The benefits of decentralisation are likely to be mixed according to the capabilities and objectives of each local authority.

Observations from the Preliminary Evaluation

The text below describes the findings from our preliminary evaluation and provides an indication of the priority areas that may merit further exploration.

Regulation

The introduction of greater regulation in the form of a commissioner or regulator has the potential to increase accountability if the individual or body is equipped with appropriate powers; however, by introducing another body into an already crowded sector, there is a risk that roles and responsibilities become further confused, undermining transparency. Appropriate and considered regulation is needed to mitigate this risk

The legal barriers for a Regulated Asset Base model are higher as legislators are likely to demand greater evidence that this more expansive form of regulation is required . Our initial evaluation has not found justification for the more onerous regulation that would be present under a Regulated Asset Base model.

Decentralisation

Passing responsibility for the management and / or procurement of ferry services to local authorities through decentralisation could narrow the perceived gap between communities and decision makers. This could have benefits for accountability and transparency.

Evidence from Norway and other sectors suggests that passenger experience will vary according to the capabilities and priorities of the responsible local authority.

The ability of Ministers to effect change would be reduced as they would no longer be directly responsible for procurement.

It is possible that the positives associated with decentralisation could be achieved via other means that would avoid the complexities mentioned above.

Integration

By reducing the number of parties within the Tripartite through integration it may aid clarity, which has the potential to improve transparency and accountability in the sector.

By merging two members of the Tripartite there will be a stronger alignment of those organisations’ objectives. There may also be opportunities to achieve efficiencies in their operations, e.g. vessel maintenance.

CMAL possesses technical expertise that TS depends on. Were it to be integrated with CFL or DML, consideration would need to be given to how TS could retain this capacity.

There are a large number of taxation, legal and accounting issues associated with integrating or assimilating two members of the Tripartite. The cost associated with resolving these issues need to be more fully understood and judged in the context of Ministerial priorities.

Privatisation

Serco NorthLink Ferries (SNF) operate the NIFS contract and has demonstrated the success with which a private operator can deliver ferry services. TS could divest its interests in the ferries sector and depend on the private sector to deliver ferry services on the CHFS network however, in recent CHFS procurements there has been limited competition.

Without its ferry interests, TS / Scottish Ministers would be in a weak position to step in as OLR, a requirement for lifeline ferry services.

There are likely to be significant tax and accounting implications associated with the sale of CMAL.

The SG’s objectives with regards to DML’s commercial mandate require greater clarity to assess if this remains a desirable direction of travel.

Preliminary Evaluation

It is possible that a combination of options could deliver enhanced value for TS. It may therefore be desirable to introduce a number of these options, recognising that the timescales for each of their introductions may differ.

| Negative | Neutral | Positive |

|---|---|---|

| Unlikely to achieve Best Value | Requires further research to understand whether Best Value can be achieved | Potential to achieve Best Value |

| Evaluation Criteria | Passenger Experience | Deliverability | Accountability and Transparency | Overall potential to achieve Best Value |

|---|---|---|---|---|

| Commissioner or Regulator | Neutral | Positive | Positive | Positive |

| Regulated Asset Base | Positive | Negative | Neutral | Neutral |

| Evaluation Criteria | Passenger Experience | Deliverability | Accountability and Transparency | Overall potential to achieve Best Value |

|---|---|---|---|---|

| TS / CMAL assimilation | Neutral | Negative | Positive | Negative |

| CMAL / DML integration | Positive | Neutral | Positive | Positive |

| CMAL / CFL integration | Positive | Neutral | Positive | Positive |

| CMAL assets privatised | Negative | Negative | Neutral | Negative |

| CFL does not bid on the next CHFS contract | Neutral | Neutral | Neutral | Neutral |

| Cease focus on non-core commercial operations | Neutral | Neutral | Positive | Neutral |

| Local authorities procure ferry services | Negative | Negative | Positive | Negative |

| Local authorities procure ferry services inc. vessels | Negative | Negative | Positive | Negative |

| TS manage major routes and smaller routes passed to local authorities | Neutral | Negative | Positive | Neutral |

The summary table adjacent presents the preliminary scores awarded to each option.

- The introduction of a commissioner or regulator could increase independent oversight of the sector and serve as a helpful interface between the Tripartite and the public. Lighter touch regulation of this kind is considered more appropriate than a Regulated Asset Base model, which may be excessive and not contribute towards Best Value due to it being ill suited to the challenges facing the sector.

- Integration of CMAL and CFL is the most attractive option from the ‘integration and assimilation’ grouping; it offers the opportunity to streamline the structure of the Tripartite while maintaining separation from DML’s commercial activities. It would present a number of complex legal and taxation issues, which need to be more fully understood as part of the detailed evaluation.

- Limited benefits were identified in relation to privatisation. Some merit was noted in relation to the cessation of DML’s non-core operations; however, in order to explore this option fully, more clarity is needed regarding Ministerial priorities for DML.

- Complete decentralisation of ferry services on the west coast of Scotland was not judged to be desirable. Partial decentralisation and de-bundling of routes may provide a more pragmatic means of bridging the gap between decision-makers and local communities. Other means by which local communities and the relevant local authorities can formally input into the sector could also be explored as an alternative to structural change.

Key Recommendations

We recommend that when considering the future of the CHFS network, communities are consulted on the proposed future options and a Business Case exercise is undertaken to further appraise the indicative preferred options with reference to Ministerial objectives.

- In this report we have indicatively identified a number options for the CHFS network which merit further detailed evaluation by TS and its stakeholders

- The long list has been developed with reference to our international benchmarking exercise and a review of domestic sectors judged as being relevant to the ferries sector.

- We have set out an evaluation framework which can be used to evaluate the options in a robust and transparent manner.

- We have included below an overview of this report’s key recommendations and next steps based on the evaluation we have undertaken.

Consultation (short term)

Prior to any further decisions on the contract or future regulatory / structural reform, we recommend further consultation with local communities.

Commercials (short term)

The current CHFS contract expires in 2024. Contracts of this nature commonly take in the region of 18 to 24 months (excluding preparatory phase) to procure. All three of the commercial options could conceivably be introduced to the CHFS network. Prior to embarking on any procurement exercise, an assessment of the desired commercial position vis-à-vis TS’ future objectives for the ferry sector should be undertaken to understand how contractual changes could support the delivery of these objectives.

Regulation (medium term)

Enhanced regulation could be introduced in the form of a commissioner or regulator. Implementing either would give more oversight and bring the ferries sector into line with the rail sector in the UK. A full economic assessment of the remit of a commissioner or regulator would need to be undertaken if more independent oversight is deemed a Ministerial priority.

Structural reform (medium term)

The industry could be restructured to become more integrated, increase private sector involvement or enhance the role of local authorities. Our preliminary assessment highlights an integrated model between CMAL and CFL as an option which has the potential to contribute towards the achievement of Best Value. We recommend TS consider this framework and long-list of options as part of a Business Case and full options appraisal to help identify a preferred way forward for the future of the CHFS network.

At this stage of the evaluation we have sought to understand the benefits and disbenefits of a number of commercial considerations, enhanced regulation and structural reform.

The options proposed may be complementary but do not necessarily need to be implemented at the same point in time.

We recommend that when considering the future of the CHFS network, long-term objectives are factored into all key decisions, including any commercial considerations relating to CHFS3.