The Strategic Case

The Strategic Context – Results from the pilot

The pilot worked by ScotRail removing the timing restrictions on the off-peak fares and products which they set and control that were previously only valid on off-peak services, so they are valid to travel all-day. No other train operators participated in the Pilot.

The aims and objectives of the Pilot were as follows:

- Improve awareness of rail as a viable travel choice

- Improve access to rail by reducing the cost of travel at peak times, enabling more people to travel more often

- Reduction in private car travel as more people choose to travel by rail

As part of the trial ScotRail strengthened some services (adding carriages to some trains) where there was a concern around overcrowding and continually monitored the situation using on-train systems.

An interim report was published in June 24 and a “final” report in August 24. This final report found that under what was viewed as the most realistic scenario – that without the Pilot in place, demand would have returned to 90% of pre-pandemic levels as reflected across the rest of the UK – there was an increase in demand from the pilot of 6.8%. This represented around 4 million extra rail journeys over nine months, of which 2 million are journeys that would previously have been made by private car. This is in the context of around 5 billion annual private car journeys in Scotland and represents a reduction of less than 0.1% of car based carbon-emissions.

There remained some uncertainty around the demand impacts, with a more negative view suggesting that the impact was instead around 2.4%. This had a resultant impact on the estimates of costs which were in the annual range of £25 million to £30 million per annum (in 2024 prices) with the possibility of being as large as £40 million. Noting that these figures include the additional costs incurred by ScotRail as well as the net loss of revenue.

There were regional variations in the impact with the greatest being observed in the Central Belt, specifically on the East Suburban network around Edinburgh and the Express Edinburgh to Glasgow routes. There was some evidence that the pilot encouraged commuting from smaller towns into larger population centres.

The Value for Money (VfM) analysis, suggested that the removal of ScotRail peak fares had a Benefit Cost Ratio of between 1.2 and 1.5 or between £1.20 and £1.50 of value for each pound of cost. Taking into account the relative incomes of those benefiting (tending to be those on above average income), reduces this to 1.0 to 1.25. This represents between £1 and £1.25 of value for every £1 spent.

The surveys undertaken identified some emerging evidence of sustained behaviour change arising from the Pilot, including shifting the time of travel from off-peak to peak and mode shift from car to rail. This evidence suggests around half (52%) of existing rail users who changed their behaviour because of the Pilot, have made at least one rail journey that they previously made using another travel mode, with half of those journeys from car. Of those new rail passengers identified as switching from other modes, 54% had previously used a car as a driver, and a third had switched from bus. However, this is in the context of an estimated increase in demand of 2.4% on the lower end and 6.8% at the higher end – meaning the vast majority of the increase in passengers were existing rail users making existing journeys. This finding is useful in the context of a pilot – people are unlikely to make long term choices based on a pilot and the impact of making the change permanent will be considered below in terms of revised objectives.

There is some moderate evidence that the Pilot encouraged rail use amongst low to middle income households whilst primarily benefiting existing users who tended to be above average income. There is strong evidence that the Pilot has helped existing users who are in work and encouraged greater rail travel amongst this group but has had a lower impact in encouraging full-time workers who did not use rail to use it. Again it is reasonable to suppose that a temporary pilot would not necessarily encourage longer-term choices such as taking up employment that required a rail journey to easily access. In terms of age, there is some, relatively weak evidence that the Pilot has encouraged older users to use rail when they didn’t before and has encouraged 31- to 40-year-old existing users to travel more by rail.

In summary, the Pilot was somewhat successful in meeting the objectives of increasing awareness of rail and improving access but had more minimal impacts on overall car travel and tended to benefit those on higher incomes within the Central Belt. What is clear, however, from the robust analysis undertaken, is that there was not a hugely significant shift from car to rail use and this was the rationale for not continuing it at a time when budget pressures were such that difficult choices over alternatives needed to be made.

The current position

When the trial ended, Flexipasses were made more flexible and the number of journeys increased by 20% for the same price and a temporary discount, of 20%, was offered on season tickets until the end of September 2025. This was to ensure that the end of the trial did not result in a significant reduction in demand.

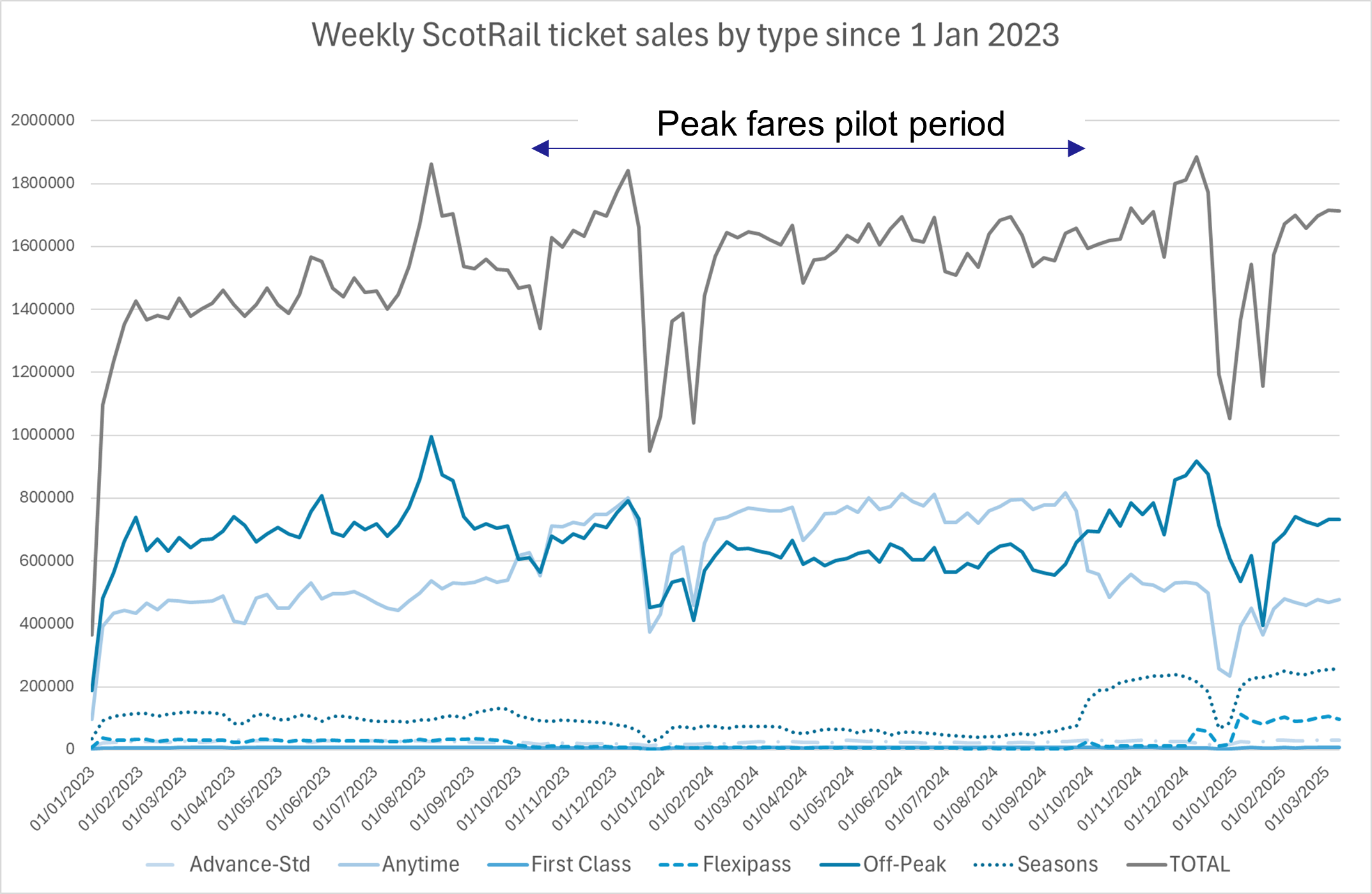

What happened was that demand continued to increase when the trial ended albeit at a slower rate (this is covered in more detail below). The way the trial was implemented meant that the type of ticket purchased no longer reflected time of travel (as both peak and off-peak tickets continued to be available for the same cost and with no restrictions on usage for either). This is reflected in the profile of demand by ticket type shown in the diagram below.

This diagram shows ScotRail weekly ticket sales by ticket type. It shows that during the trial and after the trial ended, demand continued to increase and that after the trial there was a significant shift to flexi-passes and season tickets.

Whilst inflation has fallen back from its high levels in 2023, there are still pressures on household budgets and inflation has started to rise again (with perhaps further small rises expected in Summer 2025).

Scottish economic growth has strengthened at the start of 2025. Scottish GDP grew 0.7% in the 3 months to February, strengthening from zero growth in the final quarter of 2024. However, business surveys continue to indicate weakness in business activity. Business concerns regarding falling demand are reflective of the risks from weak consumer sentiment. This reflects a range of domestic and global trade uncertainty factors that are weighing on consumers sentiment regarding the economy and their household financial security

Inflation rose in April to 3.5%, driven by increases in energy and water bills. In their baseline forecast, the Bank of England expect inflation to rise temporarily to 3.7% in September before gradually declining back towards 2%. However, the recent cut in Bank Rate to 4.25% should help support consumer and business activity in the face of this heightened uncertainty.

The labour market continues to perform strongly, with the unemployment rate at 4.3%. Nominal earnings growth remains broadly stable, the recent rise in inflation has seen the pace of real earnings growth slow to 2.2% in April

All of this is reflected in a broad based downgrade of economic forecasts from the end of last year with UK growth now expected to weaken slightly in 2025.

The economic backdrop suggests that the permanent removal of peak fares will be a welcome boost to travellers, helping to offset inflationary pressures on their budgets and slow growing incomes. It is likely to also be welcomed by businesses as it will leave consumers who currently travel by train with more disposable income, as well as encouraging more people to make trips by train.

Current GB level modelling forecasts increased rail revenue and journeys in the coming year driven by increased commuting due to changing workplace policies and higher disposable incomes. Revenue is forecast to continue to grow in subsequent years, although journey numbers are expected to flatten out. These forecasts do not take account of the abolition of peak fares in Scotland.

The constraints on meeting the challenges

The key practical issue arising from the pilot was its temporary nature – it is reasonable to expect that rail users would be unlikely to make permanent lifestyle or work choices (moving house or moving job) based on a temporary change to the system. The announcement of a permanent change means that the longer term implications of the policy need to be given due consideration.

There are a number of practical implications of removing peak fares on a permanent basis. These include but are not limited to:

- What to do about Seasons/Flexis – during the trial Seasons and Flexis remained on sale at the previous price for those that were willing and able to pay for the flexibility that they offered. If peak fares are permanently removed then it would be sensible to reprice seasons and flexis to reflect a saving on the new base fares this retaining a proportion of the non-price based benefits for passengers (budgeting, fewer purchases) and to ScotRail in terms of revenue stabilty.

- A further complication is the existence of timing restrictions on Railcards and concessionary fares. This creates a potential anomaly if peak fares are permanently removed but there are complications with some Railcards being subject to UK level terms and conditions.

- Super Off Peak fares (a further discount on a limited number of trains) were removed during the pilot but reinstated, in a limited manner – on train or ticket office sales only – when the pilot ended. A decision needs to be made as to whether they are permanently removed with the abolition of peak fares.

- Practicalities around assignment of revenue between operators – the ORCATS system that assigns revenue between operators on the same routes (GNER and Cross country services within Scotland) is UK wide and makes the distinction between anytime and off-peak tickets. The system will not easily deal with the removal of a ticket type from Scotland.

- ScotRail do not provide services to/from Reston Station or the bulk of services at Lockerbie Station. These services are provided by UKG operators. As such passengers using those stations will not benefit from the removal of peak fares from ScotRail services.

Objectives and Assessment Criteria (CSFs)

The original objectives of the pilot were to:

- Improve awareness of rail as a viable travel choice

- Improve access to rail by reducing the cost of travel at peak times, enabling more people to travel more often

- Reduction in private car travel as more people choose to travel by rail

Based on the strategic issues discussed above it is sensible to adjust them to reflect the permanent nature of the announced change. The revised objectives are:

- Improve access to rail by permanently reducing the cost of travel at peak times, enabling more people to travel more often and make long-term choices with certainty

- Reduction in private car travel as more people choose to travel by rail

- Simplify the range of ticketing options available in order to make the system easier to use and simpler to run

These revised objectives are judged to align well with the FM priorities of:

- Eradicating Child Poverty

- Growing the Economy

- Tackling the Climate Emergency

- Ensuring High Quality and Sustainable Public Services

Conclusions and rationale for change

The result of the pilot was broadly positive, but the policy was not taken forward due to budget constraints. The strategic case somewhat strengthens the rationale for intervention given the continued use of rail (in terms of easing affordability issues for the people of Scotland) and the uncertainty over the wider economic situation.